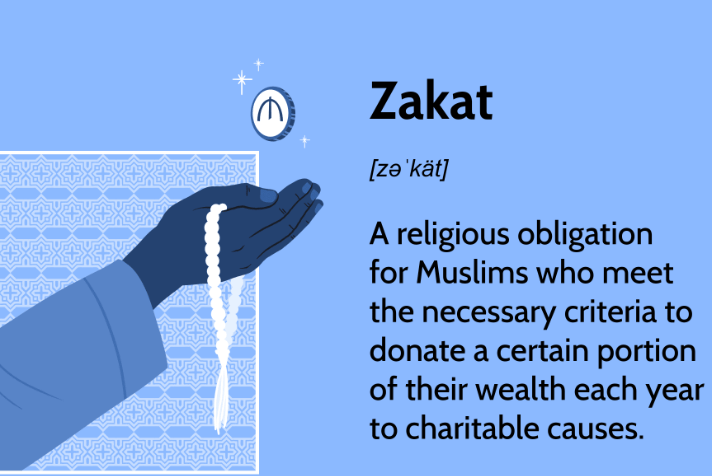

This article will explain can you pay Zakat with credit card? Finding a suitable and trustworthy way to pay Zakat might be difficult for Muslims residing in the US, UK, Canada, or Europe. Zakat, a charity given to needy people, is regarded as a way to purify one’s wealth.

However, it’s crucial to choose a donation method that is reliable and effective. We advise paying Zakat from the US, UK, Canada, or Europe utilizing the online platform provided by Transparent Hands because of this.

It enables people to give directly to those in need while maintaining complete openness in using funds.

Can you pay zakat with credit card?

Zakat can be paid with a credit card, but the payer must remember to settle the debt on time to avoid paying interest. The preferable option would be for the payer to pay the Zakat in cash or tradable products to avoid interest costs and to avoid using a credit card if they cannot settle the debt in full before any interest charges.

Loans and Zakat: How do we calculate?

One should always keep the Islamic day in mind while purchasing the fixed Nisab quantity, currently 612.36 grams of silver, for the first time. If one is still the owner of Nisab the next year on the same (Islamic) date, they will be regarded as Sahib al-Nisab and must pay Zakat at 2.5% on all zakat-able assets.

It doesn’t matter if one’s money increases or falls throughout the year, and it’s optional that one’s possession of all of one’s riches last the entire year.

If, however, all of one’s wealth is lost for any reason, then the new date and the zakat calculation will take place when one once again owns Nisab. (See: al-Lubab fi Sharh al-Kitab, 1/145; Bada’i al-Sana’i, 2/96–98)

To calculate zakat, you and your husband should have a set date. If you haven’t already, set a date as soon as possible so you can calculate your zakat on that particular day.

If you are unsure of the precise date when you acquired Nisab for the first time, make a prudent guess and start calculating your Zakat on that day.

You may deduct the various obligations owed as of that date from the value of your zakat-eligible assets because zakat is not required on wealth that one owes to others.

The amount of the debt will be subtracted from the owner’s overall net worth. Therefore, if you and your husband decide to divide the debts equally (regardless of whose credit card was used), you each have the right to remove the appropriate sum from your combined assets.

If one of you assumes responsibility for paying off the debt, the debt will only be subtracted from that person’s overall net worth.

Finally, it is not essential to deduct the debt from the wealth of the person whose credit card was used; instead, one of you might transfer this duty to the other, who can accept it.

If this is the case, each of you will subtract the portion of the debt that they have agreed to pay back.

As a side point, you should avoid engaging in riba (usury), as this is a serious sin. Therefore, it will be illegal and must only be done if interest is levied if you can pay off the monthly credit card payments.

Utilizing a credit card is only permitted if the cardholder is confident in their ability and willingness to settle the balance with the firm issuing the card before interest is due.

Are Credit Cards Haram or Halal?

The Two Views

Some academics (like this one, for instance) contend that using credit cards is illegal since doing so amounts to signing a fundamentally illegal contract (since you agree to pay interest in case of a delay).

Others, such as Pro. Monzer Kahf and Sh. Faraz Rabbani considers credit cards acceptable as long as the cardholder does not borrow money from the credit card business.

I tend to have the latter opinion for the following four reasons:

- Using a credit card to borrow money is not prohibited in and of itself.

- Interest fees for late payments are built into every contract we sign in modern culture.

- Credit cards offer additional advantages.

- Interest is one of many sources of revenue for credit card corporations.

- The act of borrowing is itself, not haram:

If you’re confident you can repay the money at the end and before interest accrues, borrowing money from someone interest-free is not in and of itself illegal.

That feeling makes sense. However, introducing a sophisticated financial tool like a credit card clouds the issue. So let’s step back for a while. Imagine that we recently borrowed £100 from our neighbour and committed to repay him in a month.

When our neighbour Jeremy begs us for £100 monthly, we fail to repay him. How is Jeremy going to proceed? He will file a lawsuit against you in court for £100 with interest.

- Interest payments for late payment are hard-wired into our economy:

Our economy is built with the “plus interest” as compensation for late payments. In many of your contracts, you will be obliged to pay interest on your bill if you pay your invoices late.

If we were being fair in our approach, we would have issues signing a simple utility deal or even a mobile phone contract because, technically, that is the same contractual structure as the credit card.

I’m making a point here: we need to grasp fiqh issues in the context of real-world issues and understand the larger ramifications of the argument.

I do not, however, imply that Muslims must accept this. No, we should write our contracts to avoid interest fees for late payments, and in cases where we are dealing with a sizable consumer base, we should mount a unified campaign on this issue.

(Perhaps, if you think this is a good idea, IFG could write to a few big utilities and request a change to the contract for Muslims. Let us know if you believe that is the best course of action.) But for the time being, we must accept it.

- Credit cards come with certain other benefits:

However, you are not required to use a credit card. However, you do need to sign up for contracts for your cell phone, utilities, and internet.

Credit cards do, however, have several advantages of their own that must also be considered: You receive protection on your purchases, which is crucial in the age of online shopping and global commerce (who would search down a company that has gone out of business in the Philippines for your trainers?).

Additionally, due to the reduced fees and better currency rates, most people who travel abroad use credit cards.

Let’s pay attention to the bigger picture of this issue. What do you recommend in place of a credit card? Yes, you’re using your debit card.

However, we occasionally need to remember that when we deposit money into our account, we lend it to our bank so they can lend it to others and earn from the interest.

Therefore, if anyone is sincere about this position, they should keep their money in gold rather than cash, which is also an IOU. and only pay in gold at the neighbourhood store.

This could be challenging but not impossible. New credit cards are backed by gold, which is an intriguing twist. Would you like to read more about these in a future article? Let us know in the comments section if so.)

- Credit card companies don’t just make profit from interest:

A credit card firm has a different revenue stream from each card because they charge businesses for transaction processing as a debit card company does.

Therefore, it is still profitable for a credit card firm, even for people who never accumulate debt.

Therefore, claiming that “they’re only giving you credit so you go into debt is impossible.” That statement has some validity, but it hardly presents the whole picture.

Conclusion:

There you have it, everyone. If you liked this, you’d love our other article on can you pay Zakat with credit card. Please let us know if this was useful and if you have any comments or questions.

If you did find it useful, we would be very appreciative if you shared it with people in your network who might be interested.

FAQs:

Can I use my credit card to pay Zakat?

It is simple, safe, and transparent to pay Zakat with Transparent Hands. We accept online payments using credit cards, debit cards, bank transfers, and other safe payment methods. For individuals who would rather make gifts through your neighbourhood bank, we now offer a wire transfer option.

Can Zakat only be given in cash?

If a needy person asks you for money and says, “If you receive money for me, then buy me such and such with it,” you must give them cash; you cannot give them money in the form of other products. There is nothing wrong with it in that instance.

Can I give Zakat to my father, who is in debt?

Allah is to be praised. Given that the son is obligated to spend on his father, it is not allowed for the father to receive the zakaah from his son to pay off the debt if the father takes on the obligation to spend on himself.

Muhammad Talha Naeem is a seasoned finance professional with a wealth of practical experience in various niches of the financial world. With a career spanning over a decade, Talha has consistently demonstrated his expertise in navigating the complexities of finance, making him a trusted and reliable figure in the industry.