You can have inquiries about linking your Venmo card with Apple Pay, regardless of whether you currently use Venmo or want to get started. You might also be interested in learning How To Add Venmo Debit Card To Apple Wallet?

How To Add Venmo Debit Card To Apple Wallet?

The credit card cannot be added to your Apple Pay account; only your Venmo debit card may. To use your Venmo debit card, open the Wallet app on your phone, press (+), tap Debit or Credit Card, and then scan it. You may now purchase from your Apple Pay account using your Venmo money!

Can You Add A Venmo Debit Card To Apple Pay?

Adding a Venmo debit card to Apple Pay is harder than it sounds. You must manually add your bank’s debit card to the process. Although no method works for everyone, there is a workaround for those who wish to avoid a hassle.

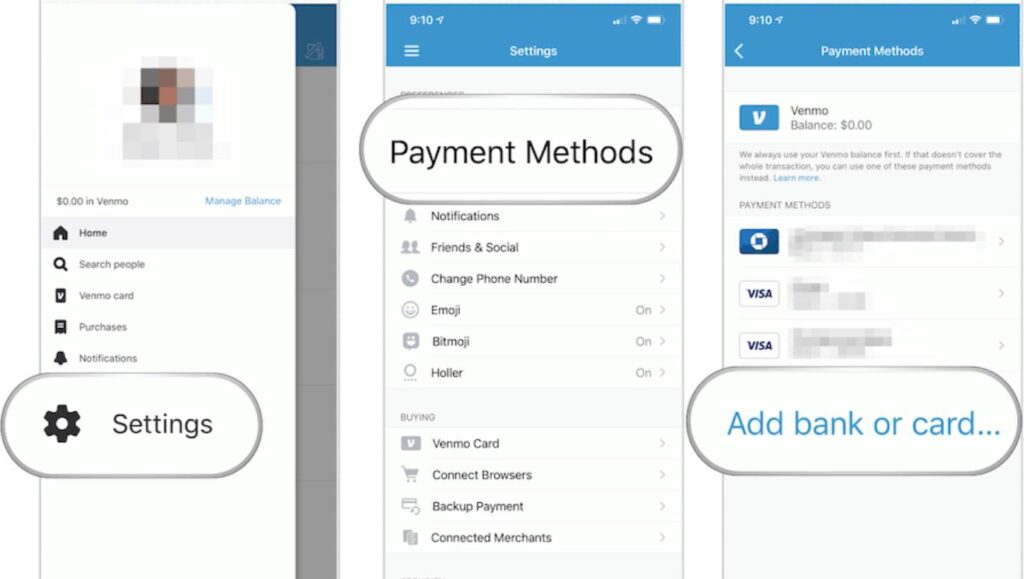

You must sign into your Venmo account and select the Cards option to connect your bank card to Venmo. After selecting the Cards tab, you will be requested to add a debit card.

You can use either an AMEX card or a Chase debit card. You may also provide a credit or debit card from a different bank.

A notification indicating an error will appear when you add your card. The money will then move to your Venmo account, which will need some waiting.

If you have a debit card, the money will move to your Venmo account in roughly a day. Additionally, Venmo will charge you a 3% service fee.

Venmo and Apple are two businesses that need to get along better. Apple has signed agreements with Google Pay, Samsung Pay, and Apple Pay, but not Venmo.

Apple Pay and Samsung Pay do not work with the debit card from Venmo.

However, you can integrate Google Pay or Samsung Pay with your Venmo card. You can use this to make online purchases and at merchants who accept Venmo. You can buy things using your Apple Wallet as well.

Enrolling in a direct deposit and connecting your bank card to Venmo is a good idea. You can do this to get paid two days ahead of schedule.

Checking with your bank to be sure there are no overdraft fees is also a good idea. When using Venmo at an ATM, you cannot get overdrawn.

You can also make purchases using your Apple Pay card at locations that accept Apple Pay. You can purchase using Venmo’s Instant Transfer feature at merchants accepting the payment method. You cannot use it to make mobile purchases, though.

The ideal approach to using Apple Pay with Venmo is to act as a middleman and use a regular bank debit card. You may feel more secure and at ease as a result of this.

Using a regular bank debit card as an intermediary is the other obvious solution to the problem of how to connect a Venmo debit card to an Apple Wallet.

For instance, using a Chase Debit Card, you can add a Venmo card to your Apple Pay account.

This would give you the best of both worlds: you could use your Venmo card to make payments at places where Venmo is not accepted and your Apple Pay debit card to purchase at places that accept it.

Can You Transfer Money From Your Venmo Balance To Your Bank Account?

Online payments are made much easier when you have a Venmo balance. However, you must ensure you have the right information if you’re seeking a way to transfer that balance to your bank account.

The following advice will help you sync your Venmo balance with your bank account.

You must first connect your bank account to Venmo. If you wish to send money to pals, this is crucial. To ensure you have money to make transactions, you can link your Venmo debit card to your bank account.

By selecting “Add Money” on the Venmo app, you can attach your debit card if you currently use Venmo. You will then be asked to enter your bank account details.

Once your bank account is attached, you can add money to Venmo anytime by tapping the “Transfer Money” option in the app.

This procedure typically takes 3-5 business days. However, weekends and holidays may have an impact on this. You should contact Venmo for more details if your transfer shows up in your balance after that period.

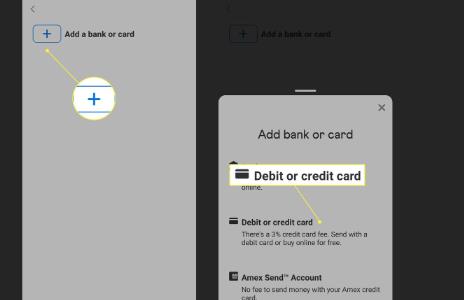

A debit or major credit card can also be added to your Venmo profile. After that, you can use that card to send money to others.

A 3 percent fee must be paid using a credit card. Before making a payment, you can, however, always review the prices that are associated with it.

Paying for a Venmo transfer with a credit card is not advised. Credit cards are not covered by the Federal Deposit Insurance Corp.

Peer-to-peer transactions are also treated as cash advances by some credit card companies. This implies that only a limited number of merchants will accept your balance.

A Venmo debit card can also be used to purchase at physical stores. To make a payment, activate your Venmo debit card and adhere to the on-screen instructions. The Venmo app may be used to make online purchases as well.

Other Venmo users may also send you money. The “Search” option in the Venmo app lets you look for a recipient. Once you’ve located them, you can enter the person’s email address, phone number, or Venmo username.

You can send them money once you’ve viewed them. You’ll need to open a Venmo account if they don’t already have one.

Additionally, you can use a bank transfer to add funds to your Venmo balance. However, this process can take a few days to show up in your Venmo balance.

After three business days, if your transfer hasn’t appeared in Venmo, you should check with Venmo to ensure it was done properly.

Can You Make Payments Between Apple Pay And Venmo?

Venmo integration with Apple Pay seems like it could be better. It would help if you ensured Venmo and Apple Pay are compatible with your credit card.

Additionally, you need to confirm that you have a balance to transfer. You can mail them to them as money or use them to make store purchases.

Venmo is slower than Apple Pay for sending money. To confirm the transaction, use Touch ID on your phone. Venmo uses similar technology. However, there are additional steps to take.

You’ll need to wait a few days before using Apple Pay to send money to a Venmo user. You must wait for the transaction to clear if the bank does not support Venmo’s Instant Transfer feature.

Venmo is less secure than Apple Pay. Anyone can see the virtual number that Venmo uses on your phone. Apple Pay uses a Touch ID to confirm the transaction.

You’ll also need to use the same technology to use Venmo to send money to friends. This is a compelling argument against using Venmo.

Venmo forces you to wait a few days while Apple Pay can immediately send you money. You can also select a private option to make your transactions more covert.

By connecting a regular bank account to your Apple Pay account, you can also indirectly conduct transactions through Apple Pay. However, doing so will cost you a lot of money.

The ideal method for sending money to a buddy is Apple Pay, especially if you need to send a quick payment. However, sending money to a friend via Venmo’s Instant Transfer option is also great.

You’ll have the money in your account within a few business days after your friend approves the pricing. There is a weekly cap on the number of transfers you may make with Venmo, unlike Apple Pay.

You will need to wait a few days for your money to be credited to your account if you attempt to make more than the maximum amount. Use Apple Cash instead of Venmo if you still need to decide if you’ll have enough money to send a payment that way.

A virtual card called Apple Cash functions as a debit card in Apple Pay. It is used online, via apps, and in stores. Additionally, Apple Cash gives cash back.

The Apple Cash card, however, can only be used if your name is the same as the name on your bank account.

Users of the mobile payment software Venmo may pay for nearly anything. Users can add a debit card to purchase or send money to friends and family.

Venmo can be used to make ATM withdrawals as well. However, you should pick a card that can offer you money back if you want to utilize Venmo to make a significant transaction.

How Can I Add Venmo Card To Apple Pay?

You already know that adding your cards to Apple Pay makes it simple to make payments. The procedures for adding your Venmo card to your Apple Wallet are described here:

- Be sure to have your Venmo card handy. You must already have it, but it’s important to understand that only a card may be added to Apple Wallet, not your Venmo application or profile. As a result, you should always have your Venmo card on hand.

- Start your device’s Wallet application. To enter all the details and card information, locate the Wallet app on your device and open it.

- As soon as you launch the program, a plus symbol will appear in the top-right corner of the screen.

- add your Venmo debit card to Apple Pay by providing its data. Check to see if the card was properly added to your Apple Wallet. Either manually enter the information into your Apple Wallet or scan the card to enter all the information automatically.

- Use your Venmo card to make payments once all the procedures have been completed and followed appropriately.

How To Add Venmo To Apple Pay Without Card?

Your Venmo account profile or app cannot be added to Apple Pay or Apple Wallet. The only method to integrate your Venmo debit card into Apple Pay is to use that card and input all the necessary information.

You must first link your Venmo account with an acceptable bank account before you indirectly link your Venmo account to Apple Pay.

You must then connect that bank account to Apple Pay so that it has access to all of your Venmo account information. You can now transfer funds from your Venmo account to Apple Pay. For that, you won’t require a card.

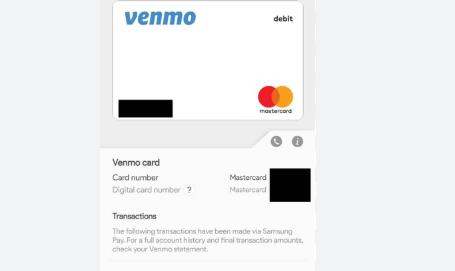

How Do I Use My Virtual Venmo Card? How To Use Your Digital Venmo Card?

To begin, you must first activate your Venmo credit card. To do this, you must take the card and use the QR scanner or camera on your device to scan the front.

Alternatively, you can enter the CVV code, a three-digit activation code for the app. To contact Synchrony Bank and activate your card, call 855-890-6779.

You can use your Venmo card to complete your payments once activated. Go to the view and pay area of the Venmo app after launching it on your device. Here, you can make payments using your Venmo credit card.

Conclusion

It’s simple to carry out all your transactions or send payments using your Venmo card. You may add your Venmo card to Apple Pay to simplify the payment process.

To add venmo debit card to Apple Wallet, follow the thorough instructions covered above. When finished, you can quickly pay using the Venmo card in your wallet.

Frequently Asked Questions

Can Venmo debit cards be used in Apple Pay?

Venmo Visa credit cards cannot be added to Apple Pay; however, the Venmo MasterCard debit card may. Your available Venmo balance will be deducted immediately when you use a Venmo debit card. If you use your bank account as a middleman, you can convert your Venmo balance to Apple Cash to use it with Apple Wallet.

Does Venmo give you a virtual debit card?

As soon as your application for the Venmo Credit Card is accepted, you can use a virtual card number in the Venmo app. You can request a new virtual number in the Venmo app, which deactivates your old virtual card number, and use that number for online purchases.

Muhammad Talha Naeem is a seasoned finance professional with a wealth of practical experience in various niches of the financial world. With a career spanning over a decade, Talha has consistently demonstrated his expertise in navigating the complexities of finance, making him a trusted and reliable figure in the industry.