Physical inspections are rare for many. Paycheck delivery is now more convenient and secure than ever, thanks to direct deposit. The question My Chime Direct Deposit Is Late might still be on your mind.

The simple answer is that you can access a direct deposit as early as 12 to 6 a.m. on the morning of your paycheck. Nevertheless, the precise moment that direct deposit takes effect can change.

My Chime Direct Deposit Is Late

Your employer processed your payroll but entered the wrong date. Due to the holidays, processing takes longer than usual (direct deposits are frequently delayed when a payday falls on a bank holiday). Unintentionally, the direct deposit request was made outside of regular business hours.

How Long Does Direct Deposit Take?

Your bank and the payroll software used by your business are the key elements determining when you will actually get your direct deposit. The Automated Clearing House (ACH), a mechanism for electronic funds transfers that streamlines transactions in the United States, also plays a role.

Here is a step-by-step explanation of the operation of direct deposit:

- Your employer notifies their bank of payroll instructions: Before payday, your firm sends a payroll file comprising information about the employees’ bank accounts and pay amounts to its bank.

- The ACH processes the payroll file: An ACH operator verifies the accuracy of the payroll file and makes sure all payments are sent in the right direction.

- Your bank receives payment information to process the payment: The ACH transmits your payment file to your bank for processing.

- A deposit is made into your bank account. Once your bank gets your payment information, your money is processed and credited to your account.

Even though the ACH is involved in this procedure, your employer and bank mostly control when you get paid. This is so that your direct deposit will only be affected if your employer prepares and delivers your payroll information before payday.

The bank you pick will also affect how quickly your money is accessible. By the next business day after your bank receives the funds from the ACH, all banks must comply with law 2 and make direct deposits available.

How Does Direct Deposit Work?

A common and practical choice is direct deposit, but you might wonder how it operates. Employers must have the payee’s bank account information or a voided check to make direct deposit deposits.

The most frequent application of direct deposit is to transfer an employee’s income; however, it is also possible to utilize it to receive government benefits like Social Security or unemployment checks as well as tax refunds, investment profits, retirement account payments, and government benefits like tax refunds.

Employers provide financial institutions with their payroll data, which is then shared with the Automated Clearing House (ACH). This occurs a few days before payday to give the ACH enough time to sift and send the data to each employee’s bank. You see the money in your account when it is moved from your business to your bank.

Average Direct Deposit Times

Specific direct deposit times will vary no matter where you bank, but some banks have stronger direct deposit services than others. If receiving your paycheck earlier is crucial, look into the direct deposit policies offered by various banks.

If you now bank with a traditional, well-known institution, consider switching to an online choice (like Chime!) to receive benefits beyond early direct deposit.

How To Set Up Direct Deposit?

Setting up a direct deposit is crucial for speedy payment and avoiding paper checks. The procedure is usually the same whether you sign up for direct deposit through your workplace, a vendor, or another business.

Of course, the forms you must complete to process the request may vary depending on the company. You’ll probably require the following kinds of information:

- The routing number for your bank.

- Your account number (the account to which you want the money sent).

- The location of your bank

- A canceled check

Your routing number can be compared to an electronic address that helps make sure money is sent to the appropriate area.

On the other hand, your distinct account number serves as a metaphor for your house of money. When you set up direct deposit, these two numbers make it clear exactly where your money should go.

There is a lot of private data on a direct deposit form. Therefore it’s crucial to use caution when sending it. It’s a good idea to give this form straight to a payroll person if you operate in a traditional office setting.

Employ a secure file transfer instead of sending a standard email when submitting an electronic form. Finally, as part of the setup for direct deposit, your bank’s address and a canceled check might be utilized for extra verification.

How To Get Direct Deposit Faster?

Although many banks now offer early direct deposit up to two days before your planned payday, direct deposit gives you quick access to your hard-earned money.

You can get paid up to two days before schedule with an early direct deposit function provided by online banks like Chime.

Once your direct deposit is active, you can save some of your paychecks by sending them straight to a savings account.

Chime’s Save When I Get Paid feature makes setting aside monthly money from your paychecks straightforward. Set up direct deposit with Chime, and whenever you receive a deposit of $500 or more, Chime will automatically send 10% of that amount into your savings account.

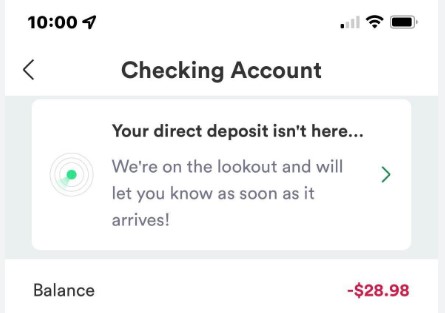

Where’s My Direct Deposit?

Chime doesn’t receive the money immediately after your company or benefits provider makes your direct deposit.

Before it gets to us, it goes through several processing stages. We instantly put the funds into your checking account after we receive them. If you didn’t receive your direct deposit, it could be because:

- It’s the first one you’ve received from a new workplace.

- It was processed in the afternoon.

- The payer modified the deposit amount.

- A payroll system issue with the payer.

You’ll receive an email and a push notice when your deposit is received. If the funds are outside your account by the time you get paid, contact your employer or the benefits provider to find out when they were deposited.

Benefits Of Direct Deposit

The use of direct deposit has several benefits. Look at a few examples:

Earlier Access To Your Money

Your employer will typically transmit your paycheck to the bank a few days before payday for extra processing time. Instead of making you wait until payday, the bank will deliver the funds as soon as the transaction is completed.

You may get your money even sooner than with traditional banks thanks to online banking services like Chime.

Faster And Safer Transactions

With a direct deposit, the payer and the payee must visit the bank. Since there is no possibility of losing a paper check, they are safer and handier.

Better Payroll Process And Saving Options

For the majority of firms, using direct deposit simplifies the payroll process. Since the money is transferred directly to the workers’ bank accounts, it enables prompt salary payments and lightens the duty of the payroll department.

You can set up automatic savings programs by splitting your direct deposit between several accounts, which is permitted by many businesses.

Each pay period, you can direct deposit $50 into your savings account and transfer the remaining funds into your bank account. You won’t need to worry about manually shifting the money when you construct your savings account in this manner.

Waive Unwanted Bank Fees

A frequent benefit of direct deposit is your bank waiving the maintenance cost. In some banks, checking accounts are subject to monthly fees, but they often don’t apply if you keep a large amount or get a direct deposit every month.

You can use features like early direct deposit1, overdraft without fees2, and more when directly depositing with Chime!

Conclusion

What to do if My Chime Direct Deposit Is Late? Direct deposit is practical, although the precise timing can vary depending on your job. Be ready; setting up direct deposit properly at a new job may take one to two pay cycles. This could mean that until everything is set up, you will still need to use physical checks.

You might get your money differently after the direct deposit is ready. This depends on several factors, including your company’s payroll software and when payroll is handled. Understanding this is crucial, especially if you plan to set up automatic transfers.

For instance, issues may arise if an automatic transfer is made before your direct deposit, which will arrive at 9 a.m. on a work day.

Find out exactly when your money will be accessible, then plan your automated transfers and bill payments for when that time comes.

Additionally, it’s vital to keep in mind that your financial institution could occasionally place a hold on your cash for a few days before releasing them to your account. Early direct deposit characteristics can, therefore, completely alter the playing field.

Frequently Asked Questions

Why is my Chime direct deposit not early?

The time the payer submits the payment file determines when funds will be available for early access via direct deposit. The day the payment file is received, which could be up to two days before the planned payment date, is typically when we make this money available.

How long can Chime hold money?

Authorization holds are displayed under Pending Transactions in the View Transactions section of your Chime app. Although car rentals could take up to 30 days, most permission holds are released within seven (7) days. Please note that merchants occasionally place numerous holds, each for a different sum.

How do I check my direct deposit status?

Checking your online bank account to see if your money has arrived will provide you with the status of your direct deposit. You should verify with the payroll division of your employer if there is a delay.

Why does Chime take so long to deposit a check?

Up to five business days may pass before your money appears in your account. We can accept more checks through our app because of the hold period that helps us ensure the check clears. After depositing the check, it will take five business days for the money to appear in your account.

Muhammad Talha Naeem is a seasoned finance professional with a wealth of practical experience in various niches of the financial world. With a career spanning over a decade, Talha has consistently demonstrated his expertise in navigating the complexities of finance, making him a trusted and reliable figure in the industry.