If you bank with Wells Fargo, you should use their mobile deposit service since it lets you quickly and securely add money to your deposit account using the camera on your phone or other mobile device. Sometimes, you can access the funds you’ve placed the day after they’ve been credited. For more information on what is the limit for mobile deposit at wells fargo, keep reading!

What is the limit for mobile deposit at wells fargo?

- Maximum per day: $2,500

- $5,000 per month (5-day period)

How Long Does Wells Fargo Mobile Deposit Take?

The type of deposit and whether Wells Fargo sets a hold on the money to determine how long it will be before you can access your Wells Fargo funds that have been deposited.

Check Deposits

- The money from your deposit is typically made available to you the following business day, provided that you deposit your check before the deadline on a business day. Here is how the deadline operates:

- On business days, deposits made before 9 p.m. Pacific Time is available the next day.

- On business days, deposits made after 9 p.m. PT are available the business day following the day Wells Fargo credits your account.

- Deposits made on weekends, holidays, Saturdays, and Sundays become available the day after Wells Fargo credits your account.

When Funds May Be Delayed?

When a check is deposited, Wells Fargo may decide to retain some or all of the funds if the check cannot be processed immediately.

In that instance, you can cancel the deposit and be informed when the funds will be available. Once the money is prepared, you’ll notice the deposit reflected in your available balance.

Transfers

You can transfer money between Wells Fargo accounts or between a Wells Fargo account and one at another financial institution using the Wells Fargo Mobile App.

As long as 8 p.m. PT completes the transaction on a business day, money transferred across Wells Fargo accounts immediately becomes available.

Even though the transfer will appear as “pending” in your account information for transfers made after 8 p.m., Wells Fargo will utilize the funds to cover transactions during its overnight processing.

It could take up to three business days for the money you move into your Wells Fargo account from another institution’s account to become available.

How Does Wells Fargo Mobile Deposit Work?

Both the Apple App Store & Google Play offer the Wells Fargo Mobile App for download., which enables you to make mobile deposits as described.

How to Use Wells Fargo Mobile Deposit to Deposit Checks?

This procedure is rather easy. Simply having a smartphone or tablet with a camera will do. The check is then separated from any stubs or loose hanging paper, and the back is signed.

The check is then placed so that it is level and well-lit on a surface that is dark in color. You then take these actions.

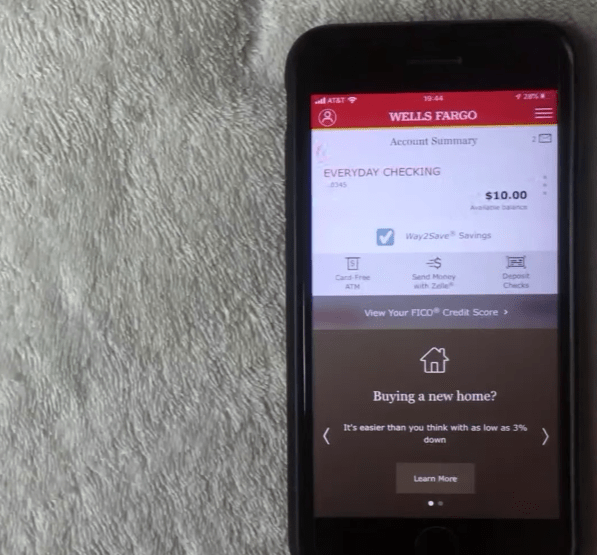

- Use the app on your phone to log into your account.

- Secondly, click “Deposit Checks.”

- Choose the account where you want the deposit from the “Deposit” dropdown option. A default account can be chosen for upcoming mobile deposits.

- Type the check’s amount as written. Under the deposit amount, you’ll see a list of your remaining daily and monthly mobile deposit allotments.

- take pictures of the check’s front and back using your device’s camera button. Make certain that the check’s corners fit inside the guides.

- Check the accuracy of the deposit details, then tap “Deposit.”

What’s Good and Bad About Wells Fargo Mobile Deposit?

Despite how handy it is, there are still some limitations to using the Wells Fargo mobile deposit feature on the app.

Pros

- Check deposits are made in a short period.

- There is no fee for using mobile deposits.

- Most deposits received before the deadline will be available the next day.

Cons

- Mobile deposit daily and monthly cap

- Only valid for government, commercial, and personal checks

- This account only accepts checking and savings accounts.

Conclusion:

Here I will sum up all above information related to the limit for mobile deposit at wells fargo, As long as account users can access the internet on the road, anywhere, Wells Fargo Online Banking gives you access to 24/7 banking alternatives from wherever you are.

Customers can now use a mobile app or online banking to pay bills, make transfers, and check their balances. This also enables bill payment via a user’s computer and mobile device.

This is a simple way to ensure you’re paying your bills on time and a terrific approach to taking charge of your finances.

Customers of Wells Fargo can use their phone or email addresses to transmit and receive money via web banking and mobile banking applications.

Customers can also examine subscriptions and recurring payments, turn cards on or off, and perform other operations.

FAQs:

Is there a limit to the Wells Fargo Mobile deposit?

Your mobile deposit is valid. When you choose a Deposit to account and are on the Enter Amount screen, Footnote 1 limits are displayed for each eligible account.

What is the daily limit for Wells Fargo?

The daily ATM withdrawal cap at Wells Fargo varies, but it typically stands at $300, which is modest compared to some of the finest checking accounts. A higher limit may be requested, although it is only sometimes granted.

How long does it take for a check to clear Wells Fargo?

The standard procedure at Wells Fargo Bank is to release deposited funds on the first business day after receiving the deposit. But occasionally, we have the right to put a deposit hold on these funds and postpone their accessibility for up to 7 business days.

Muhammad Talha Naeem is a seasoned finance professional with a wealth of practical experience in various niches of the financial world. With a career spanning over a decade, Talha has consistently demonstrated his expertise in navigating the complexities of finance, making him a trusted and reliable figure in the industry.