GoldBacks are a fascinating innovation in the world of precious metals. So, tte question arises Are GoldBacks A Good Investment? This question has been on the minds of many investors looking to diversify their portfolios. In this article, we will delve into the various aspects of GoldBacks, their pros and cons, and whether they make for a sound investment.

Key Takeaways

- GoldBacks offers a unique form of physical gold investment.

- They are not legal tender but can be used for barter and trade.

- GoldBacks are designed for small transactions.

- They are fungible and interchangeable.

- Investing in GoldBacks can be a hedge against inflation.

Are GoldBacks A Good Investment?

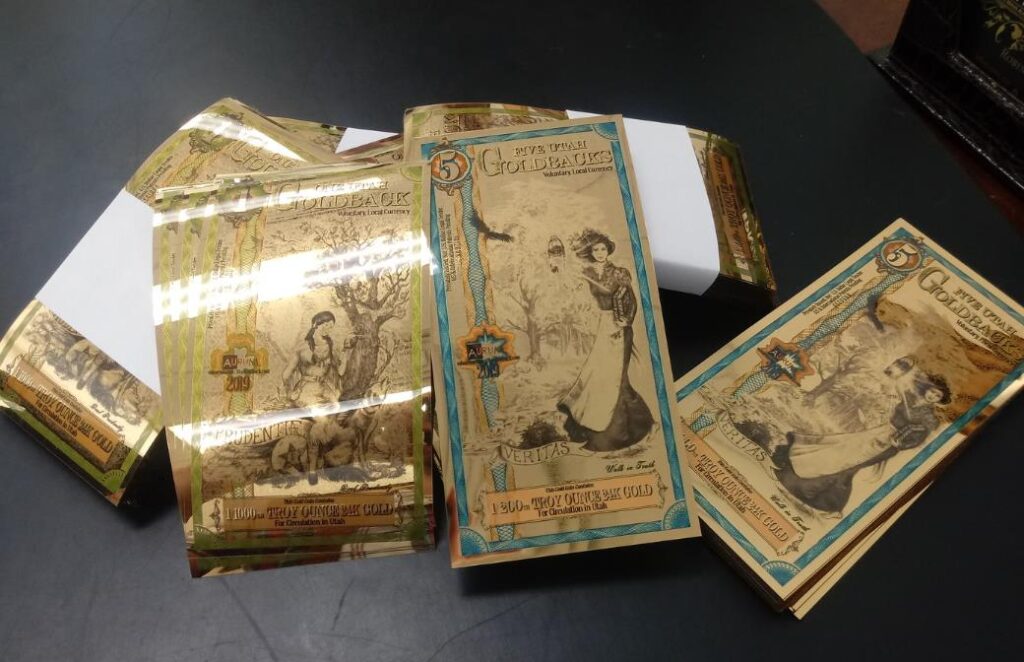

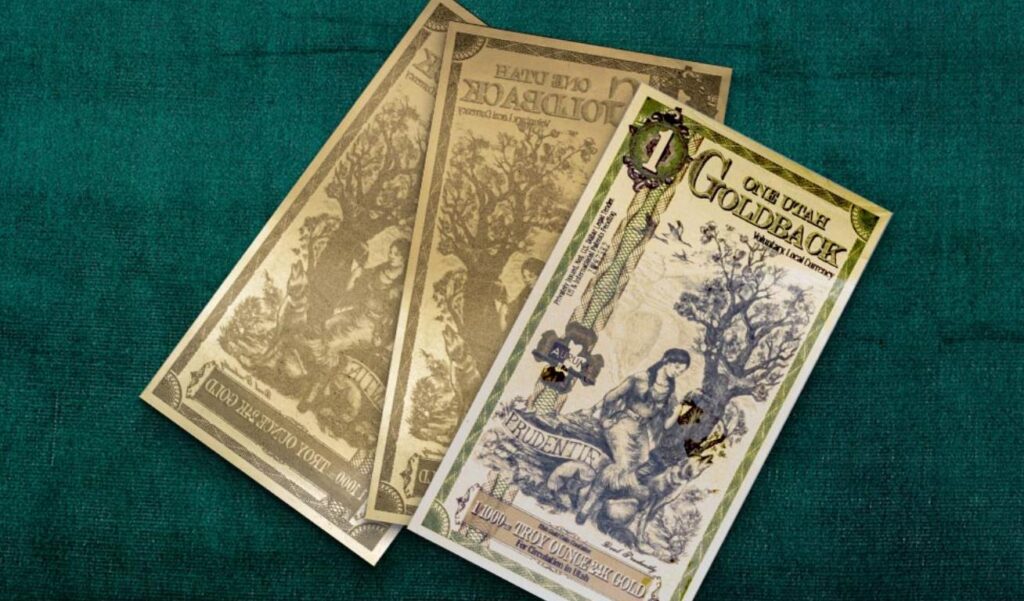

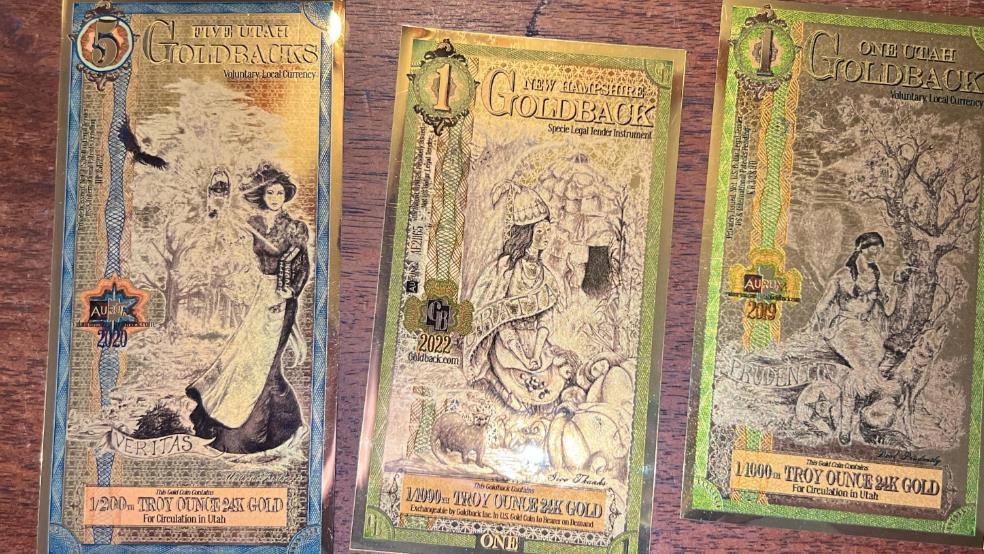

GoldBacks are the world’s first physical, interchangeable gold money designed to accommodate even small transactions. They come in various denominations like 1, 5, 10, 25, and 50, making them highly versatile.

How Are They Made?

GoldBacks are made using 5th-generation vacuum deposition technology. This ensures the quality and durability of the notes.

Advantages of Investing in GoldBacks

Investing in GoldBacks offers several unique advantages that set them apart from traditional forms of gold investment. Here are some key benefits:

Hedge Against Inflation

One of the most compelling reasons to invest in GoldBacks is their potential as a hedge against inflation. Gold has historically been a reliable store of value, and GoldBacks, being backed by physical gold, inherit this characteristic.

As inflation erodes the purchasing power of fiat currencies, the intrinsic value of gold remains relatively stable, making GoldBacks a sound investment to protect your wealth.

Fungibility and Interchangeability

GoldBacks are fungible, meaning each unit is interchangeable with another of the same denomination. This feature adds to their versatility and makes them suitable for a variety of transactions, from small to large. For example, you can exchange two Five-Goldbacks notes for one Ten-Goldbacks note without any loss in value.

Liquidity and Usability

Unlike other forms of gold investment, such as bars or coins, GoldBacks are designed to be spent, not just stored. This makes them highly liquid and usable in everyday transactions. Their small denominations allow for precise spending, making them ideal for both investment and practical use.

Low Transaction Costs

Traditional gold investments often come with various transaction costs, including broker fees and storage expenses. GoldBacks, on the other hand, are free from these additional costs since they are a form of physical currency that you can hold and spend directly.

Diversification

Investing in GoldBacks can add diversification to your investment portfolio. They offer a different risk profile compared to stocks, bonds, or real estate, providing a balanced investment strategy. Their unique features make them a valuable addition to any diversified portfolio.

Accessibility

GoldBacks are accessible to the average investor because they come in small denominations. This makes it easier for individuals to start investing in gold without requiring a large initial investment.

Legal Acceptance for Barter

While not considered legal tender, GoldBacks are accepted for barter and trade in some jurisdictions. This gives them a level of legal standing that adds to their investment appeal.

Disadvantages of Investing in GoldBacks

While GoldBacks offer several unique advantages, they also come with their own set of challenges and limitations. Here are some key disadvantages to consider:

Not Legal Tender

One of the most significant drawbacks of GoldBacks is that they are not considered legal tender. This means they are not universally accepted for all types of transactions.

While they can be used for barter and trade, their acceptance is limited to specific businesses and locations that recognize their value.

Limited Acceptance

The limited acceptance of GoldBacks can be a hindrance for investors looking for a universally accepted form of currency. While some businesses and communities accept GoldBacks, they are not as widely recognized as traditional fiat currencies, limiting their usability.

Market Fluctuations

The value of GoldBacks is tied to the current market price of gold, which can be volatile. This means that the value of your investment can fluctuate based on market conditions, posing a risk to investors who are not prepared for such volatility.

Counterfeit Risks

Although GoldBacks are made using advanced technology to minimize the risk of counterfeiting, no form of currency is entirely immune to this risk. It’s crucial to purchase GoldBacks from reputable sources to mitigate the risk of acquiring counterfeit notes.

Premium Over Spot Price

When purchasing GoldBacks, you’ll often pay a premium over the spot price of gold. This premium is not necessarily recouped when you spend or sell the GoldBacks, which could result in a loss on your investment.

Tax Implications

Investing in GoldBacks may have unique tax implications that differ from other forms of gold investment. Depending on your jurisdiction, you may be subject to capital gains tax or other tax liabilities, adding complexity to your investment.

Storage Concerns

While GoldBacks are more portable and easier to store than gold bars or coins, proper storage is still essential to maintain their condition. Physical damage or wear and tear could potentially decrease their value.

Limited Track Record

Being a relatively new form of investment, GoldBacks does not have a long track record to assess its long-term viability. This makes them a somewhat speculative investment that may not be suitable for all investors.

How to Buy GoldBacks?

Purchasing GoldBacks involves a straightforward process, but there are several considerations to keep in mind to ensure a smooth transaction. Here’s a step-by-step guide on how to buy GoldBacks:

Research Reputable Sources

The first step in buying GoldBacks is to identify reputable sources. These could be official websites, authorized dealers, or even physical stores that offer GoldBacks. Always do your due diligence to ensure that you are buying from a trustworthy source to minimize the risk of counterfeit products.

Choose the Denomination

GoldBacks come in various denominations, such as 1, 5, 10, 25, and 50. Decide on the denomination that best suits your investment or spending needs. Some investors prefer to buy a mix of denominations for greater flexibility in transactions.

Check the Exchange Rate

GoldBacks are valued based on the current price of gold. Check the exchange rate, which is usually provided on the official website or by the dealer, to know the current value of the GoldBacks you intend to purchase. This will help you understand how much you’ll be spending and whether you’re getting a fair deal.

Place Your Order

Once you’ve decided on the source, denomination, and quantity, you can proceed to place your order. This could involve filling out an online form, making a phone call, or visiting a physical store. Payment methods vary but usually include options like credit/debit cards, bank transfers, or even cryptocurrencies.

Review Additional Costs

Be aware of any additional costs that may be associated with your purchase, such as shipping fees or premiums over the spot price of gold. Factor these into your total investment cost to get an accurate picture of your expenditure.

Confirm and Complete the Transaction

After reviewing all the details, confirm your order and complete the transaction. Make sure to keep all transaction records, such as invoices or receipts, for future reference or for tax purposes.

Secure Your Investment

Once you’ve received your GoldBacks, it’s crucial to store them securely. They can be stored in a safe, a safety deposit box, or specialized wallets designed for GoldBacks. Proper storage is essential to maintain their condition and, by extension, their value.

Should You Invest in GoldBacks?

Unique Investment Opportunity

GoldBacks offers a unique investment opportunity that combines the tangible value of physical gold with the convenience of currency. They are designed for both investment and practical use, making them a versatile asset.

Hedge Against Economic Uncertainty

Gold has long been considered a safe-haven asset, especially during times of economic uncertainty. GoldBacks, being backed by physical gold, offer a hedge against inflation and economic instability, making them an attractive investment option for risk-averse investors.

Liquidity and Versatility

One of the standout features of GoldBacks is their liquidity and versatility. Unlike traditional gold investments, which are often stored and not easily liquidated, GoldBacks are designed to be spent and used in everyday transactions. This makes them a more liquid form of gold investment.

Legal and Regulatory Considerations

While GoldBacks are not considered legal tender, they are accepted for barter and trade in some jurisdictions. However, their legal standing could change based on future regulations, which is a factor to consider before investing.

Market Volatility

The value of GoldBacks is tied to the current market price of gold, which can be volatile. If you’re not comfortable with this level of volatility, GoldBacks may not be the right investment for you.

Tax Implications

Investing in GoldBacks may have unique tax implications that differ from other forms of gold investment. It’s essential to consult with a tax advisor to understand these nuances before making an investment.

Diversification

If you’re looking to diversify your investment portfolio, GoldBacks can be an interesting addition. They offer a different risk profile compared to stocks, bonds, or real estate, providing a more balanced investment strategy.

GoldBacks vs Traditional Gold Investments

When considering an investment in gold, it’s essential to weigh the pros and cons of different forms of gold investment. GoldBacks and traditional gold investments like bars, coins, and ETFs each have their unique features, advantages, and disadvantages. Here’s a comparative analysis to help you make an informed decision:

Accessibility and Affordability

GoldBacks: GoldBacks come in small denominations, making them accessible to the average investor. You can start investing in gold with a relatively small amount of money.

Traditional Gold Investments: Gold bars and coins often require a more substantial initial investment, making them less accessible to the average investor. ETFs may offer more flexibility but still require brokerage accounts.

Liquidity and Usability

GoldBacks: GoldBacks are designed to be spent, not just stored. This makes them highly liquid and usable in everyday transactions.

Traditional Gold Investments: Gold bars and coins are generally not used in everyday transactions and are often stored in secure locations, making them less liquid.

Transaction Costs

GoldBacks: GoldBacks have low transaction costs as they are a form of physical currency that you can hold and spend directly.

Traditional Gold Investments: Buying and selling gold bars, coins, or ETFs often involve broker fees, storage fees, and sometimes even insurance costs, increasing the overall transaction costs.

Hedge Against Inflation

GoldBacks: Like all forms of gold, GoldBacks serve as a hedge against inflation, preserving the purchasing power of your investment.

Traditional Gold Investments: Gold bars, coins, and ETFs also serve as a hedge against inflation and economic instability.

Fungibility and Interchangeability

GoldBacks: GoldBacks are fungible and interchangeable, making them versatile for various types of transactions.

Traditional Gold Investments: Gold bars and coins are not as easily divisible or fungible, making them less versatile for small transactions.

Tax Implications

GoldBacks: The tax implications of GoldBacks can vary depending on jurisdiction and how they are used. It’s essential to consult a tax advisor for specific guidance.

Traditional Gold Investments: Capital gains tax applies to the sale of gold bars, coins, and ETFs, and these are generally well-understood, making tax planning simpler.

Storage and Security

GoldBacks: GoldBacks are easier to store and transport due to their small size and lightweight nature.

Traditional Gold Investments: Gold bars and coins require secure storage solutions, often resulting in additional costs for safety deposit boxes or specialized storage facilities.

Risks Associated with GoldBacks

Investing in GoldBacks, like any other form of investment, comes with its own set of risks that potential investors should be aware of. Here are some key risks associated with GoldBacks:

Market Fluctuations

The value of GoldBacks is tied to the current market price of gold, which can be volatile. This means that the value of your investment can fluctuate based on market conditions, posing a risk to investors who are not prepared for such volatility.

Counterfeit Risks

While GoldBacks are made using advanced technology to minimize the risk of counterfeiting, no form of currency is entirely immune to this risk. It’s crucial to purchase GoldBacks from reputable sources to mitigate the risk of acquiring counterfeit notes.

Limited Acceptance and Usability

One of the limitations of GoldBacks is that they are not universally accepted for all types of transactions. While they can be used for barter and trade, their acceptance is limited to specific businesses and locations that recognize their value.

Regulatory Risks

GoldBacks are not considered legal tender, and their legal standing could change based on future regulations. Any changes in regulations concerning gold or alternative currencies could impact the value and legality of GoldBacks.

Tax Implications

Investing in GoldBacks may have unique tax implications that differ from other forms of gold investment. Depending on your jurisdiction, you may be subject to capital gains tax or other tax liabilities, adding complexity to your investment.

Storage Concerns

While GoldBacks are more portable and easier to store than gold bars or coins, proper storage is still essential to maintain their condition. Physical damage or wear and tear could potentially decrease their value.

Premium Over Spot Price

When purchasing GoldBacks, you’ll often pay a premium over the spot price of gold. This premium is not necessarily recouped when you spend or sell the GoldBacks, which could result in a loss on your investment.

Tax Implications

Investing in GoldBacks may have tax implications that differ from other forms of gold investment. It’s essential to consult with a tax advisor to understand these nuances.

Capital Gains Tax

Depending on your jurisdiction, the sale of GoldBacks may be subject to capital gains tax.

Gift Tax

If you are considering gifting GoldBacks, be aware that this could potentially trigger gift tax liabilities.

How to Store GoldBacks?

Storing GoldBacks is an essential aspect of maintaining their value and condition. Unlike traditional gold bars or coins, GoldBacks are more portable and easier to store due to their small size and lightweight nature. However, there are some best practices you should follow to ensure their longevity and value:

Use Protective Sleeves or Wallets

GoldBacks are delicate and can be susceptible to wear and tear, especially if frequently handled. Using protective sleeves or specialized wallets designed for GoldBacks can help preserve their condition.

Keep Them in a Dry, Cool Place

Exposure to moisture can degrade the quality of GoldBacks. It’s advisable to store them in a dry, cool place to prevent any potential damage.

Use a Safe or Safety Deposit Box

For added security, especially if you own a significant amount of GoldBacks, consider storing them in a safe or a safety deposit box. This will not only protect them from physical damage but also from theft.

Avoid Folding or Bending

GoldBacks should be stored flat to avoid any creases or bends that could diminish their value. If you need to transport them, use a flat, rigid container to keep them in pristine condition.

Label and Organize

If you own GoldBacks in different denominations or series, consider labeling and organizing them for easy identification and access. This will also make it easier for you to take stock of your investment periodically.

Future of GoldBacks

The future of GoldBacks appears promising, especially as they aim to solve a 2,600-year-old problem: making gold spendable in small, interchangeable increments.

GoldBacks supports local businesses and educates people about sound money. They are made using 5th-generation vacuum deposition technology, indicating a high level of sophistication in their production.

The Goldback Lease Program also suggests that you can earn an annual return in GoldBacks on GoldBacks you own, although the exact details are not provided. The website also mentions the possibility of creating a new Goldback State Series in the U.S. or other countries, indicating an intention for future expansion.

Adoption Rates

The success of GoldBacks as an investment and a form of currency largely depends on their adoption rates. The more businesses and individuals use them, the more valuable they become.

Regulatory Changes

Any changes in regulations concerning gold or alternative currencies could impact the value and legality of GoldBacks.

Is It A Good Idea To Buy GoldBacks?

According to the official Goldback website, GoldBacks are designed as the world’s first physical, interchangeable gold money that can accommodate even small transactions. They offer a unique investment opportunity that combines the tangible value of physical gold with the convenience of currency.

GoldBacks are not legal tender but are accepted for barter and trade in some jurisdictions. They are designed to be highly liquid and can be used in everyday transactions, making them a versatile asset.

GoldBacks also serve as a hedge against inflation, as they are backed by physical gold whose value has risen approximately 30% in the four largest currencies over the last five years.

What Is The Average Return On Investment Of GoldBacks?

The Goldback website states that the value of gold has risen about 30% in the four largest currencies over the last five years. While it does not provide specific ROI figures for GoldBacks, this statistic suggests that investing in gold and by extension GoldBacks, could offer a decent return.

The site also mentions a Goldback Lease Program, which implies that you can earn an annual return in GoldBacks on GoldBacks you own, although the exact details are not provided.

Do GoldBacks Have A Good Resale Value?

GoldBacks are designed to be highly liquid and can be used in everyday transactions, making them a versatile asset. They are not legal tender but are accepted for barter and trade in some jurisdictions.

The Goldback website states that they are fungible, meaning you can always exchange two Five-Goldbacks notes for one Ten-Goldbacks note. This fungibility enhances their resale value as they can be easily exchanged or sold at a rate that is determined by the current Goldback Exchange Rate.

However, it’s essential to note that you’ll often pay a premium over the spot price of gold when purchasing GoldBacks, and this premium is not necessarily recouped when you sell them.

Conclusion

In conclusion, GoldBacks present a unique and innovative form of gold investment. They offer advantages over traditional gold investments in terms of liquidity and transaction costs. However, they come with their own set of risks and tax implications that potential investors should consider. Their future is promising but hinges on adoption rates and regulatory landscapes.

People Also Ask

Are Goldbacks Legal?

Goldbacks are not legal tender but are considered valid for barter, trade, and discounts. They are specie legal tender in some states like Utah.

Is There a Premium Over Spot on the Goldback?

Yes, there is a premium over the spot price of gold when purchasing Goldbacks. This premium is not necessarily lost when you spend it, as the value is tied to the current gold price.

Are Goldbacks Liquid?

Goldbacks are designed to be liquid and can be converted back to cash if needed. They have been successful as a project, with nearly a hundred active ones today.

Can Goldbacks Be Counterfeited?

Although Goldbacks are made using advanced technology, there is a low risk of counterfeiting. It’s advisable to purchase them from reputable sources.

What Are the Tax Implications of Goldbacks?

The tax implications of investing in or using Goldbacks can vary depending on your jurisdiction. It’s essential to consult a tax advisor for specific guidance.

A multifaceted professional, Muhammad Daim seamlessly blends his expertise as an accountant at a local agency with his prowess in digital marketing. With a keen eye for financial details and a modern approach to online strategies, Daim offers invaluable financial advice rooted in years of experience. His unique combination of skills positions him at the intersection of traditional finance and the evolving digital landscape, making him a sought-after expert in both domains. Whether it’s navigating the intricacies of financial statements or crafting impactful digital marketing campaigns, Daim’s holistic approach ensures that his clients receive comprehensive solutions tailored to their needs.