Are you looking for Can I Split My Land If I Have A Mortgage? You’ll need to get approval from your bank and secure a partial release of the mortgage. Skipping this step could activate a demand feature clause, requiring you to pay off the entire mortgage immediately.

Key Takeaways

- Yes, you can subdivide your land with a mortgage, but bank approval is essential.

- Zoning laws can be a significant roadblock.

- Consider the value of natural resources and privacy before subdividing.

- A partial release of the mortgage is crucial for the deal.

- Each bank has its own set of rules for subdividing mortgaged properties.

Can I Split My Land If I Have A Mortgage?

Yes, you can subdivide a property that has a mortgage, but you’ll need to get approval from your bank. A partial release of the mortgage is essential for the deal to close. Skipping this step could activate a demand feature clause, requiring you to pay off the entire mortgage immediately.

Why Would You Subdivide a Property?

Subdividing your property can be a lucrative venture. It can help you unload some of the land’s upkeep burden and generate a nice chunk of profit. However, properties of any size can be subdivided, provided there’s a ready buyer.

What Can Prevent You From Subdividing Property?

Zoning Issues

Zoning laws can be a significant roadblock when subdividing your property. Always check these laws before accepting any offers to avoid getting stuck in a tough situation.

Getting Bank Approval

If you have a mortgage, you’ll need to get approval from your bank. Skipping this step can lead to legal troubles and hefty fines.

Considerations Before Subdividing Your Property

Natural Resources

Be aware of the natural resources you might be giving up when subdividing your land. This could include timber or mineral rights that could be lucrative in the future.

Privacy Concerns

Consider how the new development will affect your privacy. Make sure you’re comfortable with how the land will be used before making any decisions.

How to Negotiate With Your Bank?

To get a partial release of mortgage, you’ll need to come prepared. Bring all necessary documents, including zoning board approvals, title searches, and appraisals. The easier you make it for the bank to feel safe, the more likely they’ll consent to the sale.

The Legal Aspects of Subdividing Your Property

When it comes to subdividing your property, understanding the legal framework is crucial. You’ll need to consult with a real estate attorney to guide you through the legal intricacies. They can help you understand any covenants, conditions, and restrictions (CC&Rs) that might apply to your property.

Additionally, your attorney can help you draft any necessary legal documents, such as a new deed that outlines the newly subdivided parcels. This is an essential step in the subdivision process and ensures that you’re in full compliance with local and state laws.

The Financial Implications of Subdividing Land

Subdividing your land can have various financial implications that go beyond the mortgage. For instance, you’ll need to consider the cost of surveying the land, which can be a significant expense. A land surveyor will delineate the boundaries of each new parcel, a crucial step before any sale can occur.

Moreover, there might be tax implications when you subdivide your land. The sale of the new parcels could be subject to capital gains tax, depending on how long you’ve owned the land and other factors. It’s advisable to consult a tax professional to understand the full scope of your financial obligations.

The Role of Local Authorities in Subdivision

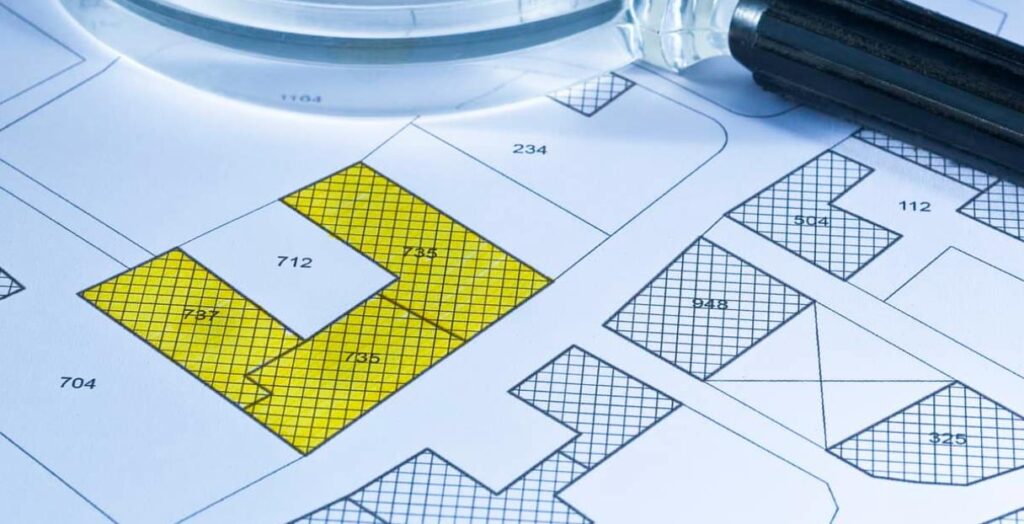

Local authorities play a significant role in the subdivision process. You’ll need to submit a subdivision application to your local planning department for approval. This often involves presenting a plat, which is a map, drawn to scale, showing the divisions of a piece of land.

Once the plat is approved, you may also need to get additional permits, such as environmental permits, depending on the land’s characteristics. Local authorities will also be involved in the public hearing process, where neighbors can voice any concerns or objections they may have about the proposed subdivision.

The Impact on Property Value

Subdividing your land can significantly impact its value. On one hand, creating smaller, more manageable parcels can make the land more attractive to potential buyers, thereby increasing its market value. On the other hand, if the subdivision leads to overdevelopment or changes the character of the area, it could potentially decrease the property’s value.

It’s essential to conduct a thorough market analysis before proceeding with the subdivision. This will give you a clearer picture of how the subdivision will affect your property’s value and help you price the new parcels appropriately.

The Emotional Toll of Subdividing Your Property

Subdividing land isn’t just a financial and legal endeavor; it can also be emotionally taxing. You might have sentimental attachments to the land, especially if it has been in your family for generations. The thought of selling off pieces of it can evoke a range of emotions, from sadness to anxiety.

However, it’s crucial to separate emotion from business in this scenario. While the emotional aspect is undeniable, focusing on practical elements like financial gain, legal compliance, and future investment can help you navigate through the emotional landscape.

What Happens With A Mortgage When You Split The Lot?

Yes, you can subdivide land with a mortgage, but there are several steps and considerations involved. First, you’ll need to check how much equity you have in the property. Most likely, you’ll either need to obtain a partial release of mortgage or refinance the property.

Lender-approval is crucial because subdividing affects the collateral of the loan. Banks usually require documentation like surveys, appraisals, and maintaining loan-to-value ratios for approving a subdivision request.

Why Do Banks Require Approval?

Banks require approval for subdivision because your property serves as collateral for the loan. If you subdivide and sell a portion, you reduce the value of the retained property and, consequently, the collateral for the bank.

Without lender consent or mortgage refinancing, you’ll be required to pay off the mortgage at the time of sale. This is crucial to understand before you start the subdivision process.

Steps for Subdividing Property with a Mortgage

- Check Eligibility: Research zoning laws and other regulations to determine if your land is eligible for subdivision.

- Get Lender Permission: You’ll need your bank’s approval to proceed with the subdivision.

- Develop a Plan: Create a detailed subdivision plan, which may require surveys or engineering reports.

- Obtain Approvals and Permits: Secure all necessary approvals and permits from local authorities.

- Make Improvements: Depending on local requirements, you may need to make improvements like extending a sewer line or creating road access.

How Do You Separate Land And House From A Loan?

Separating land and houses from a loan involves a complex process that usually requires lender approval. You’ll need to submit a complete Application for Release of Security, which includes various documents like surveys, appraisals, and subdivision applications.

Fannie Mae’s guidelines, for example, require the original loan to be current and originated more than 12 months prior to the request date. The new loan-to-value of the collateral property also plays a significant role in the approval process.

What Do Lenders Look For?

Lenders look for several conditions to be met before approving a subdivision request. These include:

- Loan Status: The original loan must be current and not have been in default over the most recent 12-month period.

- Loan Priority: No new liens should supersede the existing loan in priority.

- Structural Integrity: Any existing structures must be located completely within the boundaries of a single lot created through the subdivision.

- Legal Compliance: The subdivision must comply with all local zoning regulations and laws.

By understanding these lender requirements, you can better prepare for the process of separating land and house from a loan.

Can I Subdivide A Property With An Existing Mortgage?

Absolutely, you can subdivide a property with an existing mortgage, but it’s not a straightforward process. You’ll need to go through several steps, including obtaining lender approval. Your lender will likely require documentation such as land surveys and appraisals. The key is to maintain the loan-to-value ratios to get the green light for your subdivision project.

What’s the Lender’s Role?

Your lender plays a pivotal role in the subdivision process. They’ll assess the risk associated with subdividing the land that serves as collateral for your mortgage. Failing to get lender approval could lead to legal complications, including the possibility of foreclosure.

What Documents Are Required?

To get lender approval, you’ll typically need:

- Land Surveys: To determine the boundaries of the subdivision.

- Appraisals: To assess the value of the land post-subdivision.

- Zoning Approvals: To ensure the subdivision complies with local laws.

When Do I Inform My Bank About A Subdivision?

The best time to inform your bank about a subdivision is before you even start the process. Early communication with your lender can save you from future headaches. It’s crucial to understand your mortgage agreement and any clauses that could be triggered by a subdivision.

Why Is Timing Crucial?

Timing is everything when it comes to informing your bank. Early engagement allows you to understand the bank’s requirements and prepare the necessary documentation. It also gives you time to negotiate terms, if needed.

What Could Go Wrong?

If you don’t inform your bank early, you risk:

- Legal Consequences: Such as triggering a ‘Due on Sale’ clause.

- Financial Penalties: Additional fees or higher interest rates may apply.

- Foreclosure: In extreme cases, the bank might initiate foreclosure proceedings.

By understanding these nuances, you can navigate the complexities of subdividing a property with an existing mortgage more effectively.

What Do I Need For My Bank To Approve A Subdivision?

To get your bank’s approval for a subdivision, you’ll need to present a well-documented case. The bank will require a partial release of the mortgage, which is crucial to proceed. You’ll need to provide land surveys, zoning approvals, and appraisals. Each lender has its own set of rules, so it’s advisable to consult a lawyer to understand your specific requirements.

What Documents Are Essential?

- Land Surveys: To outline the new boundaries.

- Zoning Approvals: To ensure compliance with local laws.

- Appraisals: To evaluate the post-subdivision value of the land.

What Risks Are Involved?

Skipping the bank’s approval can activate a demand feature clause, requiring you to pay the full mortgage amount immediately. Always consult your lender to understand the risks and requirements.

Can I Sell Subdivided Land With A Mortgage?

Yes, you can sell subdivided land even if it’s mortgaged, but with conditions. Your bank must first approve the sale, as the land serves as collateral for your loan. Once approved, you’ll receive a partial release of the mortgage, meaning the sold land is no longer part of the mortgage collateral. However, you’re still responsible for the entire loan balance.

How Does Partial Release Work?

A partial release of mortgage frees the sold land from being collateral but keeps you accountable for the loan. It’s essential to understand this to manage your financial responsibilities effectively.

What’s the Bank’s Perspective?

From the bank’s viewpoint, the subdivision is a gamble. They’ll lose a piece of collateral, so they need assurance that the land’s increased value will cover their debt position. Always come prepared with all required documents to make the process smoother.

Conclusion

In conclusion, splitting your land when you have a mortgage is possible but involves several considerations. From bank approval to zoning laws, each step is crucial for a successful subdivision. Always weigh the pros and cons to make an informed decision.

From consulting professionals to understanding the role of local authorities, each step is vital for a successful subdivision. Always remember, the devil is in the details, so thorough preparation is key to navigating this complex process successfully.

Frequently Asked Questions

What Are the Legal Roadblocks to Subdividing Property?

Two main legal roadblocks can prevent you from subdividing your property: zoning issues and bank approval. Zoning laws may restrict the type of development that can occur on your land. Additionally, if you have a mortgage, you’ll need to get approval from your bank to proceed with the subdivision.

What Should I Consider Before Subdividing My Property?

Before subdividing your property, consider the access to natural resources you may be losing, how the property will be used after the sale, and the impact on your privacy. Also, evaluate the actual value of the property to ensure you’re not missing out on long-term benefits.

How Do I Negotiate With My Bank for a Partial Release of Mortgage?

To get a partial release of a mortgage from your bank, come prepared with documents that show how the land will be used, approvals from zoning boards, title searches, utility bills, and an appraisal. Each lender has its own set of rules, so consult a lawyer to understand the specific requirements.

What Are the Financial Implications of Subdividing My Property?

Subdividing your property can have various financial implications, including the cost of land surveying and potential tax implications. The sale of the new parcels could be subject to capital gains tax, depending on various factors like how long you’ve owned the land.

A multifaceted professional, Muhammad Daim seamlessly blends his expertise as an accountant at a local agency with his prowess in digital marketing. With a keen eye for financial details and a modern approach to online strategies, Daim offers invaluable financial advice rooted in years of experience. His unique combination of skills positions him at the intersection of traditional finance and the evolving digital landscape, making him a sought-after expert in both domains. Whether it’s navigating the intricacies of financial statements or crafting impactful digital marketing campaigns, Daim’s holistic approach ensures that his clients receive comprehensive solutions tailored to their needs.