Check out How to transfer money from depop if you’re seeking a sustainable way to buy and sell items online and want to list some of your possessions.

Traditional thrifting was difficult because of the pandemic, but this software allows you to acquire unusual items and launch a profitable online company.

Depop has become one of the most popular online marketplaces for reselling with a global community of buyers and sellers and offers buyers and sellers a safe platform to purchase and sell.

Therefore, if you enjoy thrifting and wish to profit from it, you may wonder what Depop is.

One of the apps that promotes accessible slow fashion and gives vendors a side business is this one.

How to Transfer Money from Depop?

On Depop, getting paid is simple. You don’t need to do anything since every time you make a sale, the money is automatically transferred to the PayPal account you’ve already linked to your Depop account.

After the funds have been sent, you can move them to your bank account.

Depop is a marketplace that has experienced rapid growth since its launch. Since being acquired by the online marketplace Etsy, its growth has slowed and been further accelerated.

Any expanding firm will experience significant change, and depop is no exception. With the advent of depop payments, depop is changing how it manages its transactions.

How do Depop Payments Work?

Almost all transactions on Depop were first processed through PayPal, so any sales you made were immediately credited to your PayPal account.

Depop has switched to a system powered by Stripe Connect for payment processing. Your bank account will now get the proceeds of your sales instead of PayPal.

This change gives depop and its users—buyers and sellers—a lot more options regarding how payments are processed.

Depop payments were introduced because large marketplaces can’t always rely on external payment processors like PayPal.

Many well-known marketplaces now handle their payment processing or, at the very least, are more involved with it. For very similar reasons, we’ve even seen eBay move to implement something similar with eBay-controlled payments.

Advantages of depop payments

The benefit of having easier-to-understand costs should be obvious. Most depop fee calculations require you to consider the external processing fees that Paypal has.

You can use this depop fee calculator to streamline the process, but it can be initially unclear.

With depop payments, you only have to consider one straightforward cost rather than taking into account the percentages taken by several firms.

Although PayPal is a very popular tool for online shoppers, it does have some drawbacks. Buyers can frequently only use their card or funds in their PayPal balance to make payments.

Depop can now take new payment methods, including Apple Pay and Google Pay, due to the switch to depop payments.

You will have better odds of selling if you have more options (more on this later).

Running your Depop shop is much simpler because your transactions and balance are all in one location.

Drawbacks of depop payments

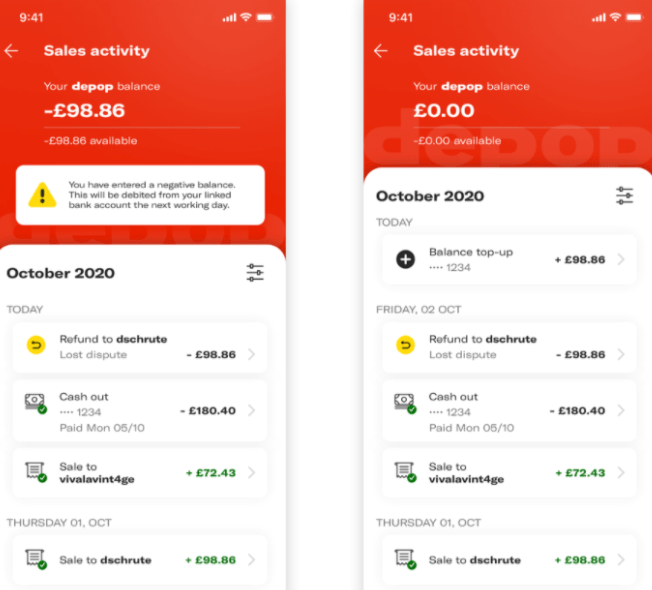

Depop payments take time to process. With depop payments, it will take longer for your money to get into your bank account.

PayPal payments are frequently received instantly, and you can frequently spend your money as soon as it does.

Before transferring your money to your bank account, Depop payments process payments in roughly 2 working days.

Isn’t that a significant departure from instant? For certain merchants, this might be a serious drawback!

How to get started selling on Depop?

All you need to sell on Depop is a phone and a PayPal account. You may register an account for free and download the application from the Google Play Store or Apple Store (Depop also has a website, but the app has additional features).

Additionally, you’ll need to open a PayPal account to get paid for the goods you sell.

Depop takes part in each transaction even if you are not charged for having an account.

Every product sold on the marketplace generates a 10% commission for Depop. Paypal, a payment processor, adds an extra 2.9% and $0.20 to each transaction.

Finding a ‘distinct edge’ for your shop, which distinguishes it from competitors, whether in the products you offer or how you style your images, is something Mary Milk, a top seller on Depop, has been doing for four years, advises.

Keep your sense of identity in your shop, added Yeo, because if you carve out that niche, customers will return for it.

Additionally, merchants must be aware of what customers desire. For Lyuu, this entails replicating some of her creations and frequently purchasing Vivienne Westwood and Dior clothing from the early 2000s.

When it comes to finding things, Milk, Lyuu, and Yeo all shop at thrift shops for used goods. Yeo looks for natural textiles when they go thrifting, and Lyuu looks for clothing she can fix.

As a seller, you will have the choice of either covering the cost of shipping yourself or charging the customer.

The caveat is that free shipping increases the likelihood that things will sell: According to Depop, if you pay for shipping, your item may sell up to 60% faster.

Yeo charges shipping to her customers because she thinks businesses should be reimbursed for the labor, supplies, and expenses of transporting goods.

If you decide to offer free delivery, you’ll need to include in that expense in addition to the fees Depop and Paypal charge.

For instance, if you estimate that your item is worth $20, shipping might cost $7, and the Depop and Paypal fees might be roughly $2.80, giving you $10 in net revenue—and that’s before you include in the cost of purchasing the item.

You might wish to set the price of your item at $30 to cover these expenses.

Finally, Yeo and Milk advise consistently and regularly adding and updating listings. You change one element of your listings when you update them: the price, the hashtags, or the description.

By doing this, you’ll move your listing up in the app’s list of pertinent search results, increasing the likelihood that someone will view your item.

My first thing to sell on Depop, a pair of skinny Levi’s pants, took about three weeks after I started an account this summer.

I updated my listings daily, liked other people’s things, and followed other sellers to give the impression that I was active on the app.

Indeed, it paid off: Since June, I’ve sold nine items, ranging from worn-out overalls to a crocheted beige crop top.

Although shipping, packing, and taking pictures for listings are a pain, it’s good to have gotten some additional cash by selling clothes that would have otherwise sat unused in my closet.

Depop is a simple method to start reselling clothes and earn a little extra money, regardless of whether your goal is to start selling clothing as a full-time job or to get rid of some items cluttering your wardrobe.

Is it required to make depop payments?

Depop payments are necessary for qualifying vendors, but PayPal is still an option! And you ought to do this since it broadens your alternatives.

Whether you like it as a seller or not, Depop payments will continue to exist for a long time. If you sell on Depop, the only other choice is to expand to other markets.

To automatically list from Depop to other marketplaces like Vinted, eBay, Poshmark, and more, utilize a cross-listing program here!

You must accept the new system and set up depop payments if you want to undertake something other than branching out seems like something you want to undertake at the moment.

Will receiving depop payments boost your sales?

You probably don’t care how your money is sent as long as you get it in your hands as fast as possible. As a depop seller, you should be concerned about whether depop payments will boost your sales.

Depop payments can enhance your sales by giving your potential customers extra ways to pay, as mentioned earlier.

Paypal is well-known, but only some people want to use them. You still need to log in, and if you don’t have an account, you’ll need to pull out your card and complete a form.

In other cases, you might even be forced to sign up for PayPal, which some buyers may not want to do.

The advent of mobile payment ways like Apple Pay would benefit the company since depop is frequently used through a mobile app.

This lowers the possibility of a user “abandoning their cart” because they think using PayPal will be too difficult. This is especially true if they still need to get a PayPal account.

When using Apple Pay, for instance, making a transaction requires just two button clicks and a facial ID rather than many logins and credit card information.

Since most internet shopping is usually the least thoughtful or well-thought-out procedure, any unneeded friction may cause them to leave.

In other words, your chances of receiving payment increase with how simple it is for others to pay you.

Can You Transfer Your PayPal Balance to Depop?

Although you can transfer money from Depop to PayPal, you cannot do the opposite. You cannot transfer funds from your PayPal account to your Depop account.

This is because PayPal receives a transactional fee each time you use stored funds in your PayPal account to make purchases. Depop also opened up Depop balancing, but very few users use it.

Some users encountered technological difficulties when attempting to use the Depop balance, while others were unsure how to proceed.

Additionally, since you may link the two accounts together and utilize funds from one account to make purchases on the other, you do not need to transfer funds from PayPal to Depop.

There is no need to go through a drawn-out process; this method is simpler.

What are the transfer limits for Depop and PayPal?

There are no transfer restrictions for Depop’s users. Most users who sell or buy clothing on Depop make little profit.

Depop decides to set a transfer cap on the amount that can be transferred from each account. In such a situation, Depop will be less popular than it is right now.

For most people, it will start to cause problems. If you have a confirmed PayPal account, you can make one transaction of up to 60,000 USD.

This also depends on whether your PayPal and bank accounts have been validated. However, only new users are subject to the 10,000 USD transactional cap.

You can only send 4,000 USD from your PayPal account once if it still needs to be validated. You can also check your current PayPal transaction limitations from your profile settings.

PayPal Depop: Is it secure?

Using Depop with PayPal is completely secure. All purchases must be made through PayPal, where the buyer may use their PayPal balance or a debit or credit card until Depop builds its payment mechanism.

PayPal is a secure online payment method because of end-to-end encryption and two-factor authentication.

Conclusion

For those who have never used it nor have little knowledge of it, Depop can be a complicated website. You may make some additional money selling your unwanted or unused stuff on Depop, which could be useful.

As the procedure is simple and quick, you also do not need to bother about transferring money from depop to your PayPal or bank account.

However, if you see that the funds need to be transmitted, contact the management and address any problems you may be experiencing.

Frequently Asked Questions

How can I receive my payment from Depop?

Depending on the buyer’s chosen payment method, you’ll either get payment through PayPal or Depop Payments. You must additionally pay payment processing costs in addition to our 10% cut of the total transaction amount (more information can be found in our Terms of Service).

Do you receive money from Depop in your bank account?

Your payout will be paid into your bank account and added to your Depop Balance if you sold something using Depop Payments.

Muhammad Talha Naeem is a seasoned finance professional with a wealth of practical experience in various niches of the financial world. With a career spanning over a decade, Talha has consistently demonstrated his expertise in navigating the complexities of finance, making him a trusted and reliable figure in the industry.