This blog post has all the information about Is Semiconductor Equipment Giant A Better Investment? Investing in semiconductor equipment giants is a hot topic. With a market predicted to reach $185.22 billion by 2033, it’s a sector that investors can’t ignore. Let’s dive into why this industry is a lucrative investment opportunity.

Key Takeaways

- Semiconductor Equipment Market to Reach $185.22 Billion by 2033

- High Demand in AI, Machine Learning, and Consumer Electronics

- Investments in the U.S. Semiconductor Sector Exceed $24 Billion in 2023

- Challenges Include Market Instability and High R&D Costs

Is Semiconductor Equipment Giant A Better Investment?

Yes, investing in Semiconductor Equipment Giants is a wise decision. The industry is experiencing rapid growth, driven by technological advancements in AI, machine learning, and consumer electronics. With a market predicted to reach $185.22 billion by 2033, it offers lucrative opportunities for investors.

High investments in the U.S. semiconductor sector, exceeding $24 billion in 2023 alone, further validate its potential. Despite challenges like market instability and high R&D costs, the sector’s promising future makes it a compelling investment avenue.

Market Overview

The semiconductor equipment market is booming. It’s driven by an increase in memory chip demand for smartphones, data centers, and consumer electronics. The market is expected to grow at a CAGR of 4.31% until 2033.

Technological Advancements in the Semiconductor Industry

Technological advancements are the lifeblood of the semiconductor industry. They not only drive innovation but also create new markets and revenue streams for companies.

Miniaturization and Efficiency

One of the most significant advancements has been the miniaturization of semiconductor components. This has led to more efficient and powerful chips, enabling the development of compact and energy-efficient devices.

AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) have become integral in chip design. These technologies allow for smarter, more efficient computing, opening doors for applications like autonomous vehicles and smart cities.

Quantum Computing

The advent of quantum computing promises to revolutionize the industry. Though still in its infancy, it offers computational power that’s unimaginable with current technology, opening up new avenues for research and application.

5G and IoT

The rollout of 5G networks is another milestone. It’s not just an upgrade from 4G; it’s a fundamental transformation that enables the Internet of Things (IoT) to flourish, connecting everything from smartphones to smart cities.

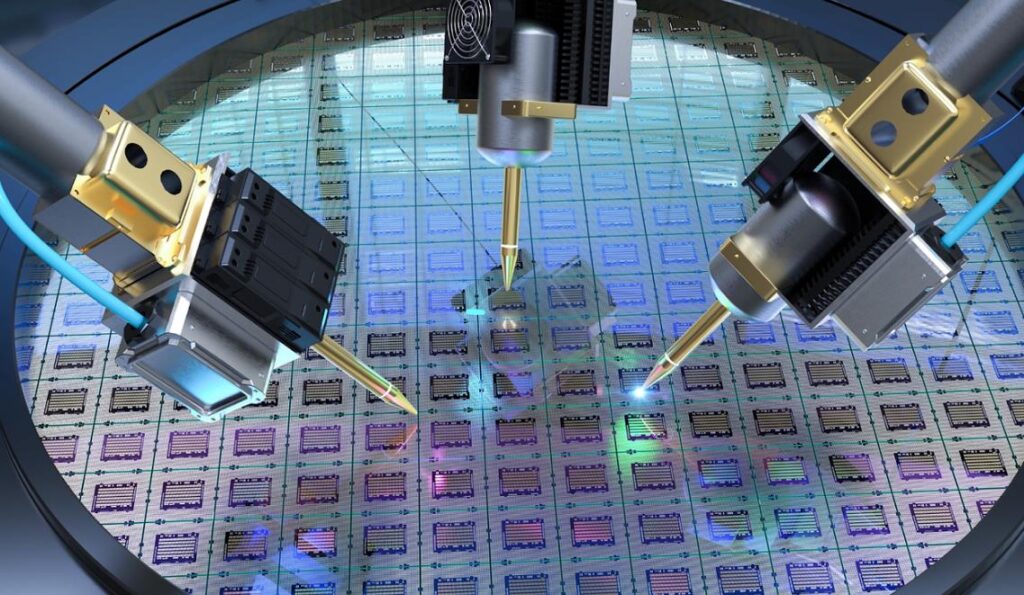

Advanced Manufacturing Techniques

New manufacturing methods, like Extreme Ultraviolet (EUV) lithography, are enabling more complex and efficient chip designs. These techniques are crucial for maintaining the pace of innovation in the industry.

Investment in the US

Since January 2023, over $24 billion has been invested in the U.S. semiconductor sector. The CHIPS and Science Act has also incentivized domestic manufacturing with $39 billion in subsidies.

Challenges and Risks in the Semiconductor Industry

Investing in the semiconductor industry comes with its own set of challenges and risks. While the sector is booming, it’s essential to be aware of the potential pitfalls.

Market Volatility

The semiconductor industry is inherently cyclical, with periods of rapid growth followed by slowdowns. This volatility can impact stock prices and investor returns, making timing crucial for investments.

Geopolitical Tensions

The ongoing tech cold war between the U.S. and China poses a significant risk. Trade restrictions and tariffs can disrupt supply chains, affecting both production and profitability.

High R&D Costs

The cost of research and development in this industry is astronomical. Companies need to continually innovate to stay competitive, and there’s always the risk that these investments may not yield profitable results.

Regulatory Hurdles

Stringent regulations, especially in countries focusing on data privacy and security, can pose challenges. Compliance requires additional investments, impacting the bottom line.

Supply Chain Issues

The recent chip shortage highlighted the industry’s vulnerability to supply chain disruptions. Natural disasters, pandemics, or geopolitical issues can lead to production halts, affecting revenue.

Future Prospects

The industry is focusing on cutting-edge fields like robotics, wearable technology, and smart home systems. These areas are expected to drive future growth.

Why Invest in Semiconductor Equipment Giants?

Investing in Semiconductor Equipment Giants is a strategic move for several compelling reasons. First, these companies are at the forefront of technological innovation.

They play a critical role in the development of AI, machine learning, and IoT—sectors that are witnessing exponential growth.

Second, the financials are strong. Many of these giants have robust balance sheets, high-profit margins, and sustainable revenue growth.

They are well-positioned to capitalize on the increasing global demand for semiconductors, which is expected to reach $1 trillion by 2030.

Third, there’s geopolitical leverage. With the U.S. and other countries prioritizing domestic semiconductor production, these giants stand to benefit from favorable policies and subsidies. For instance, the CHIPS Act in the U.S. has earmarked billions for the semiconductor industry.

Lastly, diversification is easier than ever. If you’re risk-averse, semiconductor ETFs offer a way to invest in a basket of companies, mitigating individual stock risks.

Growth Areas to Watch

Connectivity and Mobility

5G networks, autonomous vehicles, and energy efficiency are the future. Companies focusing on these areas are likely to see exponential growth.

Computing Accelerators

GPUs, once popular among gaming enthusiasts, are now essential for data centers as AI adoption increases across the economy.

Top Picks for 2023 Based on Industry Trends

If you’re looking to invest in the semiconductor industry in 2023, here are some top picks based on current trends and market performance:

- Nvidia: Dominating the GPU market, Nvidia is well-positioned to capitalize on the growing AI and machine learning sectors.

- AMD: Known for its high-performance computing and graphics solutions, AMD is a strong contender in both the CPU and GPU markets.

- Qualcomm: As 5G networks continue to roll out, Qualcomm’s expertise in mobile chipsets makes it a promising investment.

- Intel: Despite facing stiff competition, Intel’s diversification into data centers and IoT gives it a solid footing.

- Broadcom: Specializing in wired and wireless communication semiconductors, Broadcom offers a diversified portfolio that includes software solutions.

Investing in Semiconductor ETFs

If individual stock picking isn’t your thing, consider ETFs like iShares Semiconductor ETF and VanEck Vectors Semiconductor ETF for diversified exposure.

Key Factors for Long-term Investment

When considering long-term investment in Semiconductor Equipment Giants, several key factors come into play. First and foremost is Sustainable Revenue Growth. Companies that consistently expand their revenue streams are more likely to offer long-term value. Look for firms with a history of beating earnings estimates and growing sales year-over-year.

Another crucial factor is a Strong Balance Sheet. Companies with low debt levels and high cash reserves are generally more resilient during market downturns. A strong balance sheet can also enable a company to invest in R&D or acquire smaller firms, fueling future growth.

Technological Innovation is the third pillar. Companies that lead in innovation are better positioned to capitalize on future market trends. Whether it’s advancements in AI, IoT, or renewable energy, being at the cutting edge of technology is a significant competitive advantage.

Market Position and Brand Strength also matter. Companies that are leaders in their respective markets usually have stronger pricing power, customer loyalty, and operational efficiencies.

Lastly, Geopolitical Stability is essential. Companies that operate in politically stable regions are less likely to face regulatory hurdles, providing a more predictable investment landscape.

Best Semiconductor Stocks To Buy

If you’re looking to invest in the semiconductor industry, there are some top picks that you should consider. Qualcomm and Nvidia are two giants that are leading the way in innovation and financial stability.

Qualcomm

Qualcomm is a leader in mobile chip design and has been a key supplier for Apple. The company is expanding into new areas like IoT and automotive technology. With the rise of 5G networks, Qualcomm is positioned for a massive upgrade cycle, making it a strong investment choice.

Nvidia

Nvidia is the industry’s leading GPU designer. The company has been expanding the use of GPUs and has developed an extensive software library for applications like AI and machine learning. Nvidia is expected to see a 27% year-over-year increase in AI-centric systems spending, reaching $154 billion in 2023.

ETF Options

If you prefer a diversified approach, consider investing in semiconductor ETFs like iShares Semiconductor ETF and VanEck Vectors Semiconductor ETF. These ETFs offer exposure to multiple companies in the sector.

Are Semiconductor ETFs A Good Investment?

Semiconductor ETFs can be a compelling investment option for those looking to diversify their portfolio. By investing in an ETF, you’re essentially buying a basket of stocks from multiple companies in the semiconductor industry. This diversification reduces the risk associated with investing in a single company.

Risk Mitigation

One of the primary advantages of investing in semiconductor ETFs is the mitigation of risk. If one company in the ETF faces a downturn, the impact on your overall investment is cushioned by the performance of other companies in the ETF.

Exposure to Industry Growth

Semiconductor ETFs offer broad exposure to an industry that is integral to technological advancements. With the increasing demand for chips in various sectors like automotive, healthcare, and consumer electronics, these ETFs are well-positioned to capitalize on industry growth.

Cost-Effectiveness

ETFs generally have lower fees compared to mutual funds, making them a cost-effective way to invest in the semiconductor sector. They are also more liquid, allowing for easy buying and selling.

Tax Efficiency

ETFs are structured in a way that allows investors to sell their holdings without triggering a capital gains tax, making them tax-efficient.

Is On Semiconductor A Good Investment?

Yes, On Semiconductor is a solid investment choice. The company currently holds an average brokerage recommendation (ABR) of 1.50, which falls between Strong Buy and Buy. Out of 24 recommendations, 18 are Strong Buy, making up 75% of all recommendations.

Earnings Estimate Revisions

The Zacks Consensus Estimate for On Semiconductor’s current year has increased by 0.3% over the past month to $4.88. This growing optimism among analysts could be a legitimate reason for the stock to rise in the near term.

Zacks Rank

On Semiconductor has a Zacks Rank of #2 (Buy), which is a strong indicator of the stock’s future price performance. The Zacks Rank is timely and reflects changes in earnings estimates, making it a reliable tool for investment decisions.

Brokerage Recommendations

While brokerage recommendations are generally optimistic, they should not be the sole basis for investment decisions. It’s essential to validate these recommendations with other tools like the Zacks Rank for a more comprehensive analysis.

Will Semiconductor Stocks Keep Going Up?

Yes, semiconductor stocks are poised for growth. The semiconductor sector is rapidly expanding, with estimates suggesting that global spending on semiconductors will reach at least $1 trillion by 2030. In 2022, global spending was around $570 billion, according to the Semiconductor Industry Association.

Market Trends

Two significant areas of growth for semiconductor companies in the coming decade are:

- Connectivity and Mobility: This includes 5G networks, autonomous vehicles, and energy efficiency.

- Computing Accelerators: GPUs are now essential not just for gaming but also for data centers as AI adoption grows.

The U.S. accounts for nearly half of the global semiconductor spending. With substantial budgets allocated for R&D, semiconductor chips are driving technological advances in various sectors.

Volatility and Long-term Investment

While semiconductor stocks can be volatile, long-term investment in this sector is likely to be profitable. The industry’s cyclical nature means there will be ups and downs, but the overarching trend is upward.

Conclusion

In summary, Is Semiconductor Equipment Giant A Better Investment? Absolutely. Despite challenges, the sector’s rapid growth and technological advancements make it a compelling investment opportunity. With key areas like connectivity and mobility leading the way, the future looks promising.

People Also Ask

What are Semiconductors and How Are They Used?

Semiconductors are electrical components used in a wide range of consumer and industrial products. They are the building blocks of modern electronics, including smartphones, computers, and medical devices. Investing in semiconductor equipment giants means you’re investing in the technology that powers our daily lives.

Why Are Semiconductor Equipment Giants Expanding Investments in Taiwan?

Taiwan is a hub for advanced semiconductor manufacturing. Companies like TSMC are leading the way in process technology, making Taiwan an attractive location for investment. This also means that the semiconductor ecosystem in Taiwan is robust and growing.

How Are U.S. Companies Competing in the Global Semiconductor Market?

U.S. companies have pledged nearly $200 billion for chip manufacturing projects since early 2020. Amid a tech cold war with China, the U.S. is aggressively investing to maintain its competitive edge in semiconductor technology.

How to Invest in the Booming Chip-Tech Industry?

Investing in individual stocks like Qualcomm or Nvidia is one approach. Alternatively, you can invest in semiconductor ETFs for diversified exposure. Understanding the industry’s importance will guide you in making informed investment decisions.

A multifaceted professional, Muhammad Daim seamlessly blends his expertise as an accountant at a local agency with his prowess in digital marketing. With a keen eye for financial details and a modern approach to online strategies, Daim offers invaluable financial advice rooted in years of experience. His unique combination of skills positions him at the intersection of traditional finance and the evolving digital landscape, making him a sought-after expert in both domains. Whether it’s navigating the intricacies of financial statements or crafting impactful digital marketing campaigns, Daim’s holistic approach ensures that his clients receive comprehensive solutions tailored to their needs.