Are you looking for Should I Invest In FanBase? The answer is a nuanced one, depending on various factors like your risk tolerance, investment goals, and current market trends. Here’s a comprehensive guide to help you make an informed decision.

Key Takeaways

- Investing in FanBase can offer high returns but comes with risks.

- Understanding the platform’s business model is crucial.

- The regulatory environment and competition can impact your investment.

- Diversification is key; don’t put all your eggs in one basket.

Should I Invest In FanBase?

It depends. If you’re looking for high returns and are willing to take some risks, FanBase might be a good fit. However, it’s essential to do your due diligence before diving in.

What is FanBase?

FanBase is a social media platform that allows creators to monetize their content. Unlike traditional platforms, it offers multiple revenue streams, making it an attractive investment option. However, understanding its business model is crucial.

The Business Model

Revenue Streams

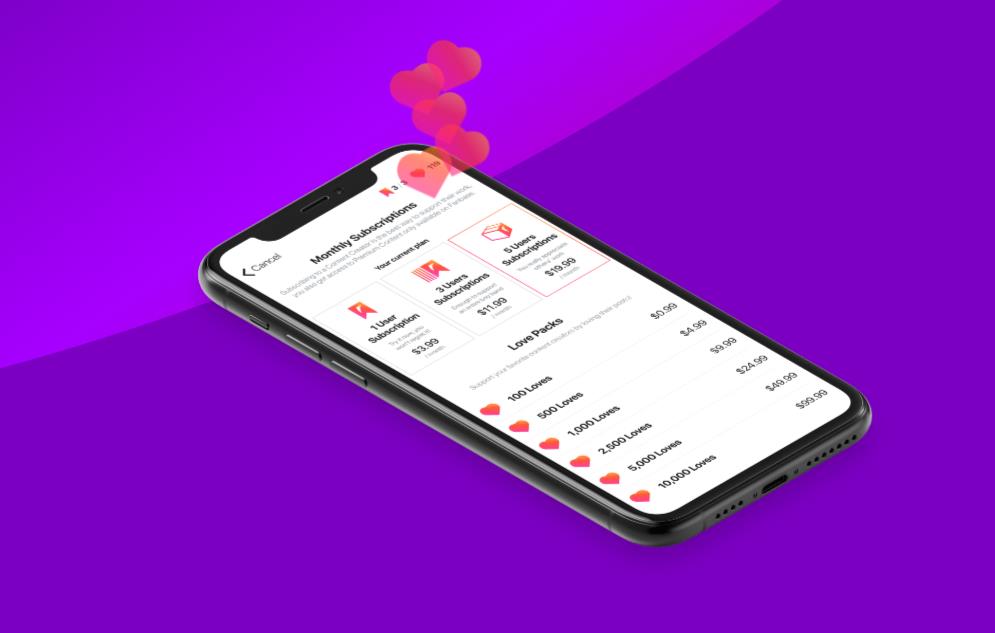

FanBase primarily makes money through subscriptions, advertising, and in-app purchases. These multiple revenue streams make it a stable investment option, but they also come with their own set of challenges.

Market Position

FanBase has carved a niche for itself in the crowded social media landscape. Its unique features and user-friendly interface make it a strong competitor, but it’s essential to keep an eye on emerging platforms that could pose a threat.

Risks and Rewards

Volatility

The tech industry is known for its volatility. FanBase, being a part of this sector, is no exception. Your investment could either skyrocket or plummet, so be prepared for a rollercoaster ride.

Regulatory Concerns

Governments are increasingly scrutinizing social media platforms. Any changes in regulations could impact FanBase’s operations and, consequently, your investment.

Diversification is Key

Don’t invest all your money in FanBase. Make sure to diversify your portfolio to mitigate risks. Consider other investment options like stocks, bonds, or real estate to create a balanced investment strategy.

Market Trends and FanBase

The social media landscape is ever-changing, and staying updated on market trends is crucial for any investment. FanBase has shown adaptability by incorporating trending features like short-form videos and live streaming. This adaptability makes it a resilient player in the market, capable of evolving with user demands.

Moreover, FanBase has been quick to capitalize on emerging technologies like augmented reality (AR) and virtual reality (VR). These technologies are expected to be the next big thing in social media, offering immersive experiences that could be a game-changer for user engagement and, consequently, for investors.

User Demographics

Understanding the user base of a platform is vital for assessing its growth potential. FanBase has a diverse user demographic, ranging from millennials to Gen Z, which is a good indicator of its broad appeal. A platform that caters to a wide age range is more likely to sustain long-term growth, offering a safer bet for investors.

Additionally, FanBase has a global reach, with a significant user base in emerging markets. These markets are untapped gold mines for social media platforms, offering exponential growth opportunities. Investing in a platform with a global footprint can provide a hedge against localized risks and market saturation.

Competitive Analysis

While FanBase has unique features that set it apart, it’s essential to consider the competition. Platforms like Instagram and Twitter also offer monetization features, and their large user bases could be a challenge for FanBase. However, FanBase’s focus on multiple revenue streams gives it a competitive edge.

On the flip side, new entrants in the social media space are continually innovating, offering unique features to attract users.

While FanBase has shown adaptability, the fast-paced nature of the tech industry means that staying ahead of the curve is a constant challenge and something investors should keep an eye on.

Long-Term Viability

When investing, it’s crucial to think long-term. FanBase has shown consistent growth since its inception, both in terms of user base and revenue. This growth trajectory indicates a potentially sustainable business model, making it a viable long-term investment.

However, the tech industry is known for rapid disruptions. What’s trending today might become obsolete tomorrow.

Therefore, while FanBase’s past performance is promising, there’s no guarantee that it will continue to dominate in the future. Investors should regularly reassess the platform’s performance and market trends.

Exit Strategy

Having an exit strategy is essential for any investment. With FanBase, you could consider selling your stake if the platform reaches a certain valuation or if it gets acquired by a larger player in the industry. Either scenario could offer a lucrative exit opportunity.

But it’s also essential to have a plan for less favorable outcomes. If FanBase starts showing signs of decline, whether due to increased competition or regulatory challenges, having an exit strategy will help you minimize losses. Always be prepared for multiple scenarios to safeguard your investment.

How To Invest In FanBase Stock?

Investing in FanBase stock is a straightforward process. The company has opted for crowdfunding through StartEngine, a platform that allows individual investors to buy shares.

The price per share is $4, and the minimum investment is $256. They offer various investment incentives and bonuses, such as early bird bonuses and tier-based perks. You can invest by visiting their StartEngine page and following the investment process outlined there.

Why Invest In FanBase?

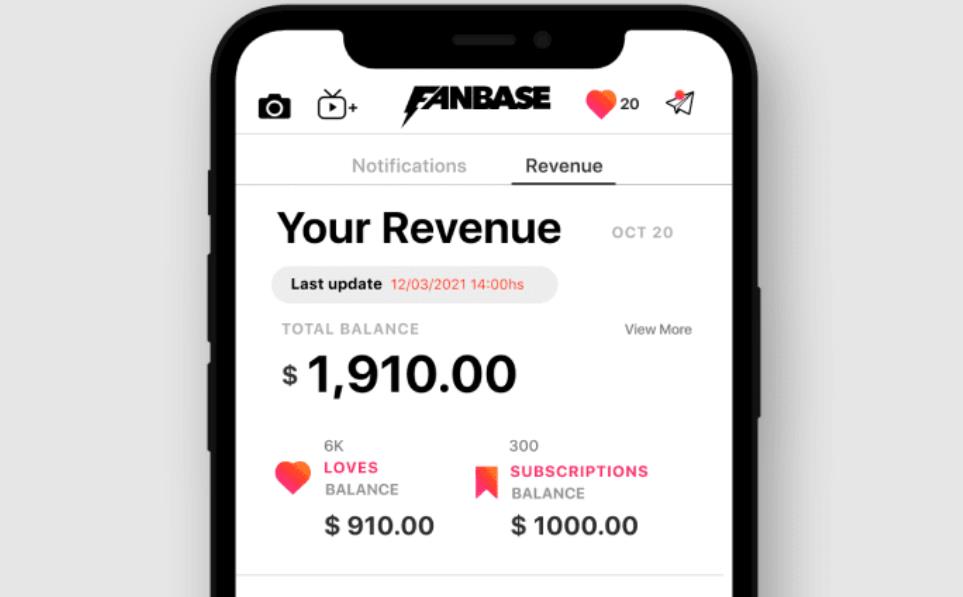

FanBase is not just another social media platform; it’s a game-changer. With over 12.7K organic users and a staggering 227% user growth in its first year, the platform is on fire. What sets it apart? A whopping 90% average margin and a robust team of tech professionals and creatives.

FanBase empowers users to monetize their content through subscriptions, offering a unique revenue model that’s a win-win for both creators and investors.

The company has a valuation of $20M and aims to disrupt the social media landscape by paying creators what they’re worth.

Can You Make Money On FanBase?

Absolutely, FanBase is designed to help users monetize their content. With over 12.7K organic users and a 227% user growth in its first year, FanBase offers a subscription-based model that allows creators to earn revenue.

Users have the option to follow each other for free or pay for a subscription to exclusive content. This model provides a lucrative opportunity for users to monetize their followings, unlike other platforms.

FanBase also offers investment incentives and bonuses. For instance, investing within the first 48 hours can get you an additional 15% bonus shares.

Different tiers like Bronze, Silver, Gold, and Platinum offer perks like early access to new features and “loves” to use on the platform. These incentives make FanBase not just a social media platform but also an investment opportunity.

How Does FanBase Pay You?

FanBase pays its users through a subscription-based model. Users can grow their following organically and have the option to offer exclusive content at a subscription fee.

This enables users to monetize their content effectively. The platform also has a robust investment structure, offering various tiers and bonuses for investors. For example, the Bronze Tier gives you early access to new features and 10,000 “loves” to use on FanBase.

The platform is transparent about its financial dealings, providing a detailed breakdown of minimum and maximum investments, the number of shares offered, and the types of assets.

With a minimum investment of $256, you can start earning through FanBase. The platform also offers time-based and amount-based perks, enhancing your earning potential.

Conclusion

To conclude, Should you invest in FanBase? The decision ultimately lies with you. Weigh the risks and rewards, understand the business model, and consider diversification. If you’re willing to take some risks for potentially high returns, FanBase could be a worthwhile investment.

People Also Ask

How Does FanBase Monetize Content?

Consistency is key when it comes to monetizing your content on FanBase. The platform suggests creating a content schedule and sticking to it. Types of content that typically yield higher results are informative and comedic videos. FanBase uses a virtual currency called “Love,” allowing users to profit from their creative work.

What Type of Content is Allowed?

FanBase allows users to post photos, 30-second videos, and 10-second stories. You can also make your content exclusive to subscribers. However, posting someone else’s content or content that doesn’t belong to you will be flagged and taken down.

Is FanBase Available Globally?

Yes, FanBase is available in over 170 countries and can be downloaded from both the Apple App Store and Google Play Store. This global reach makes it an attractive platform for potential investors looking for a wide user base.

What Are the Requirements for Video Uploads?

To upload a video from mobile, it must be at least 1 minute long and filmed in landscape format. Videos can be up to 15 minutes long, and up to 60 minutes when uploaded from a desktop. These requirements are crucial for content creators looking to monetize through video content.

Can I Import Content from Other Platforms?

Yes, FanBase allows you to import your entire TikTok and Instagram content, making it easier for users to migrate their existing content and fan base to the platform. This feature could be a significant advantage for those looking to switch platforms without losing their current following.

Muhammad Talha Naeem is a seasoned finance professional with a wealth of practical experience in various niches of the financial world. With a career spanning over a decade, Talha has consistently demonstrated his expertise in navigating the complexities of finance, making him a trusted and reliable figure in the industry.