Are you looking for What Countries In Bitlife Have No Inheritance Tax? This question is vital for players aiming to accumulate wealth without tax burdens. In this comprehensive guide, we delve into countries in BitLife where inheritance tax is non-existent, ensuring your virtual legacy thrives unencumbered.

Key Takeaways

- BitLife offers a varied tax landscape, with some countries imposing no inheritance tax.

- Understanding these tax havens enhances strategic gameplay.

- This article provides a detailed exploration of these countries.

What Countries In Bitlife Have No Inheritance Tax? [Countries with Zero Inheritance Tax]

In BitLife, several countries stand out as tax havens, especially concerning inheritance tax. These countries include:

- United Arab Emirates: Known for its lavish lifestyle and tax-friendly policies.

- Sweden: Despite its high living standards, it surprisingly offers no inheritance tax.

- Russia: A powerhouse with a tax system favoring wealth accumulation.

Each of these nations provides a unique cultural and economic backdrop, making them attractive choices for BitLife players aiming to preserve their wealth.

The Strategic Advantage

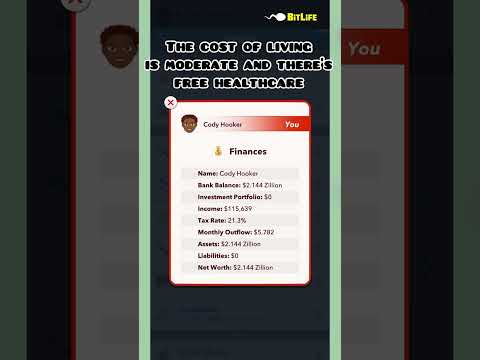

Understanding the tax landscape in BitLife is more than just about saving money. It’s a strategic tool. By choosing to reside in countries with no inheritance tax, players can ensure their virtual fortunes grow exponentially over generations. This strategy is especially beneficial for those aiming to build business empires or amass substantial wealth through various endeavors.

Cultural and Economic Implications

Wealth Management in Different Societies

In BitLife, the absence of inheritance tax in certain countries isn’t just a numerical advantage. It reflects real-world economic policies and cultural attitudes toward wealth. For instance, the UAE’s tax policies are rooted in its economic strategy to attract global wealth, while Sweden’s approach reflects its unique social welfare system.

Economic Opportunities in Tax-Free Countries

Players in BitLife can leverage these tax havens to explore diverse economic opportunities. The UAE, with its booming real estate and business sectors, offers avenues for investment.

Similarly, Sweden’s advanced economy provides stability and growth potential in various fields. Russia, with its vast resources, opens doors to ventures in energy and natural resources.

Planning for the Future: Inheritance and Beyond

Long-Term Wealth Accumulation Strategies

In BitLife, planning for the future is key. Choosing a country with no inheritance tax is the first step. Beyond that, players must consider long-term strategies for wealth accumulation. This includes investments, business development, and smart financial planning to ensure that the wealth amassed is not only maintained but also multiplied over generations.

Beyond Tax: Other Considerations

While tax policies are important, they aren’t the only factor in choosing a country in BitLife. Players must also consider other aspects like healthcare, education, and overall quality of life. These factors play a significant role in ensuring that the wealth accumulated brings not just financial prosperity but also a fulfilling life in the game.

Economic Trends and Player Strategies

BitLife’s dynamic economy mirrors real-world trends. Players must stay informed about global economic shifts and adapt their strategies accordingly. This might involve shifting assets between countries, diversifying investments, or even changing residency based on changing economic landscapes.

The Role of Government Policies

In BitLife, as in the real world, government policies play a crucial role in shaping economic opportunities. Players must be aware of not just the current tax laws but also potential policy changes that could affect their wealth. Staying ahead of these changes is key to maintaining and growing wealth in the game.

Maximizing Wealth in Tax-Free Countries

Investment Strategies in No-Tax Nations

In BitLife, countries with no inheritance tax also offer unique investment opportunities. For instance, in the United Arab Emirates, real estate investment can be a lucrative option. The vibrant property market in cities like Dubai allows for significant capital appreciation.

In contrast, in Sweden, players might focus on investing in technology startups or green energy, aligning with the country’s innovative economic landscape. Russia’s vast natural resources present opportunities in sectors like mining or oil, which can yield high returns.

Building a Business Empire

Entrepreneurial ventures in these tax-free countries can lead to massive wealth accumulation. In the UAE, launching a luxury brand or a tourism-related business can capitalize on the country’s affluent consumer base and global tourist influx.

Sweden’s advanced infrastructure and high-tech economy make it an ideal place for tech startups or cutting-edge research companies. In Russia, tapping into the manufacturing or energy sector can be a path to building a business empire, leveraging the country’s industrial strengths.

Estate Planning in BitLife

Legal Frameworks and Inheritance

Understanding the legal frameworks related to inheritance in these countries is crucial. While they may not have an inheritance tax, other laws might impact how wealth is passed down.

For instance, local laws regarding wills, trusts, and estate planning vary significantly. Players need to be aware of these nuances to ensure their wealth is distributed according to their wishes in the game.

Succession Planning for Virtual Assets

In the context of BitLife, succession planning extends beyond mere wealth transfer. It involves strategizing how to maintain and grow assets across generations. This includes decisions about education, career paths, and personal relationships for heirs, ensuring that the next generation is equipped to manage and expand the inherited wealth.

Global Mobility and Residency Choices

Strategic Relocation for Tax Benefits

Players might consider strategic relocation to maximize their financial benefits. Moving to a no-tax country can be timed with significant life events in BitLife, like starting a business or retiring. This requires balancing the timing of relocation with other gameplay elements like career progression and family decisions.

Balancing Lifestyle and Financial Goals

While financial considerations are important, they should be balanced with lifestyle choices. Players should consider the cultural, social, and environmental aspects of their chosen country. Happiness and health in the game are also influenced by these factors, making them crucial in decision-making.

Diversifying Wealth Across Borders

Global Investment Portfolios

Diversification is key in BitLife, just as in real-life finance. Players should consider spreading their investments across different countries and asset classes. This reduces risk and ensures steady growth, even if economic conditions change in one country.

Risks and Rewards of International Investments

While international investments can be lucrative, they also come with risks. Currency fluctuations, political instability, and changes in international relations can impact the value of overseas assets. Players need to be mindful of these factors and adapt their strategies accordingly.

Role of Financial Advisors in BitLife

Seeking Expert Advice

In BitLife, consulting with virtual financial advisors can offer insights into complex financial decisions. They can guide investment strategies, estate planning, and tax implications, helping players make informed decisions about their wealth.

Adapting to Changing Economic Scenarios

Financial advisors in the game can also help players adapt to changing economic scenarios. Their advice can be crucial in navigating downturns, exploiting new investment opportunities, or restructuring assets in response to global economic changes.

Conclusion

In conclusion, BitLife offers a unique opportunity to explore wealth management in a virtual environment. Countries like the UAE, Sweden, and Russia, with their no inheritance tax policies, provide strategic advantages for players.

However, it’s essential to consider other factors like economic stability, quality of life, and future policy changes. This holistic approach ensures not just wealth accumulation but also a rewarding gameplay experience.

People Also Ask

How does inheritance tax in BitLife compare to other in-game taxes?

Inheritance tax in BitLife is specifically applied to wealth transferred after a character’s death. It differs from other in-game taxes like income tax or property tax, which are based on earnings and ownership during the character’s lifetime. Each type of tax has a distinct impact on a player’s financial planning and strategy.

Is it possible to evade inheritance tax through legal means in BitLife?

In BitLife, while you can’t technically “evade” inheritance tax, you can employ strategies like relocating to a no-tax country or investing in ways that minimize tax implications within the game’s legal framework.

Can my character in BitLife receive inheritance from relatives in different countries?

Yes, in BitLife, your character can receive inheritance from relatives living in different countries. However, the inheritance tax applied will depend on the country of residence of your character.

What other factors should I consider in BitLife apart from inheritance tax?

Apart from inheritance tax, players should consider factors like the overall economic stability, healthcare quality, education systems, and cultural aspects of the country they choose to reside in. These elements impact the overall success and happiness of characters in the game.

A multifaceted professional, Muhammad Daim seamlessly blends his expertise as an accountant at a local agency with his prowess in digital marketing. With a keen eye for financial details and a modern approach to online strategies, Daim offers invaluable financial advice rooted in years of experience. His unique combination of skills positions him at the intersection of traditional finance and the evolving digital landscape, making him a sought-after expert in both domains. Whether it’s navigating the intricacies of financial statements or crafting impactful digital marketing campaigns, Daim’s holistic approach ensures that his clients receive comprehensive solutions tailored to their needs.