In this article, we’ll explain What Is Debtor Finance? Debtor finance, a pivotal financial tool, empowers businesses to unlock capital tied to unpaid invoices. This innovative solution accelerates cash flow, thus enabling businesses to maintain operations and growth without waiting for customer payments. Typically used by companies facing long invoice payment terms, debtor finance is an umbrella term encompassing products like invoice factoring and invoice discounting.

Key Takeaways

- Debtor finance improves cash flow by allowing businesses to borrow against unpaid invoices.

- Reduces the wait time for payments, aiding in smoother operational management.

- Suitable for businesses with long payment cycles or those seeking rapid growth.

- Diverse types, mainly invoice factoring and discounting, cater to different needs.

What Is Debtor Finance?

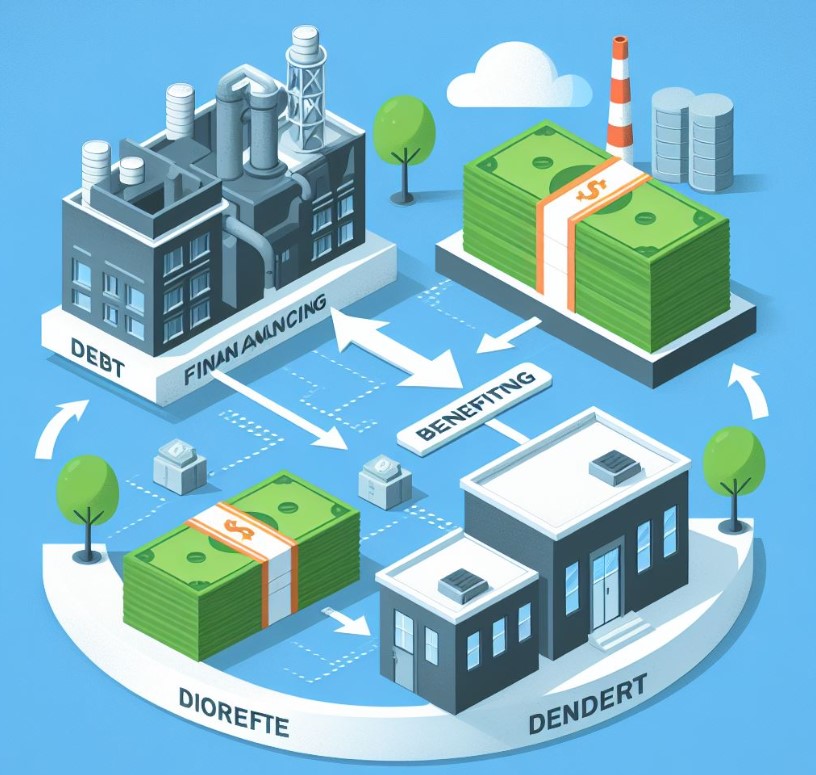

Debtor finance is a financial agreement where a business sells its invoices to a third party (a financier) to improve cash flow and reduce the wait time for customer payments. This arrangement provides businesses with immediate access to a significant percentage of the invoice value, often up to 90%, thus significantly boosting their working capital and liquidity.

Debtor finance is particularly beneficial for businesses that have long invoice payment terms but need cash to manage day-to-day operations, purchase inventory, or expand. The two main types of debtor finance are invoice factoring and invoice discounting, each catering to different business needs based on control, confidentiality, and customer interaction.

Types of Debtor Finance

Invoice Factoring

Invoice factoring, a form of debtor finance, involves selling your outstanding invoices to a factoring company. This company then manages your sales ledger and collects money owed by your customers. Factoring is not just about improving cash flow; it’s also about outsourcing your credit control functions to experts, which can save time and resources.

This method is especially useful for small to medium-sized enterprises (SMEs) that may not have extensive credit management facilities. However, it’s important to note that with invoice factoring, your customers will be aware that you are using a finance provider.

Invoice Discounting

In contrast, invoice discounting offers a more discreet form of debtor finance. Your business retains control over the sales ledger, and customer relationships remain directly between you and your clients. This method suits businesses looking for immediate cash flow while maintaining direct customer interactions.

Invoice discounting is typically used by larger, more established companies with well-organized credit collection processes. It provides the financial boost of debtor finance without disclosing the arrangement to customers.

Benefits of Debtor Finance

The primary advantage of debtor finance is improved liquidity. Businesses can access most of the invoice’s value immediately, facilitating better cash flow management. This is particularly crucial for businesses with cyclical sales or those facing seasonal demand fluctuations.

Moreover, debtor finance is a self-securing form of funding. The invoices themselves act as collateral, reducing the need for additional security and making it a more accessible option for many businesses.

Considerations When Choosing Debtor Finance

Selecting the right type of debtor finance requires careful consideration. Businesses should assess their needs for confidentiality, control over customer relationships, and the level of funding required. It’s also vital to consider the costs involved, including service fees and interest rates, to ensure that debtor finance is a cost-effective solution for your business.

How to Implement Debtor Finance?

Implementing debtor finance begins with choosing a suitable financier and understanding the terms and conditions of the agreement. It is crucial to maintain accurate and up-to-date invoices and accounts receivable records. Transparent communication with your financier and customers, where applicable, is also key to a successful debtor finance arrangement.

Implementing Debtor Finance Strategies

When integrating debtor finance into your financial strategy, it’s vital to align it with your business objectives and cash flow needs. Begin by evaluating your accounts receivable to understand the potential funding you could access.

Engaging with a financial advisor or an experienced debtor finance provider can offer insights into the best practices and how to maximize the benefits while mitigating risks.

Furthermore, it’s crucial to educate your team about debtor finance, especially those handling finances and customer communications. A well-informed team can manage the process smoothly, ensuring that invoices are processed correctly and efficiently. Implementing software that aligns with debtor finance operations can also streamline processes, reduce errors, and enhance transparency.

Advantages Over Traditional Loans

While traditional loans might seem like a straightforward solution for cash flow issues, debtor finance offers several unique advantages. Unlike traditional loans, which often require collateral and can take time to secure, debtor finance provides quick access to funds based on existing invoices.

This can be particularly advantageous for businesses that lack physical assets for collateral or those seeking to avoid long-term debt obligations.

Moreover, debtor finance aligns more closely with a business’s growth: as sales increase, so does the available funding. This flexibility is not typically found in traditional loans, making debtor finance an attractive option for rapidly growing companies.

Additionally, because the funding amount is based on sales, businesses may find it easier to manage repayment and avoid the financial strain associated with fixed loan repayments during slower sales periods.

Debtor Finance and Business Growth

Debtor finance can be a catalyst for business growth, providing the necessary liquidity to seize new opportunities. With improved cash flow, businesses can invest in marketing, inventory, equipment, or expansion efforts without waiting for invoice payments. This can significantly shorten the time to market for new products or services and can provide a competitive edge.

Additionally, the use of debtor finance can support businesses in maintaining healthy supplier relationships by ensuring timely payments. This can lead to better negotiation terms and discounts, further enhancing profitability and growth potential. By leveraging outstanding invoices, businesses can maintain a continuous cycle of investment and revenue generation, fostering sustainable growth.

Risks and Mitigation

While debtor finance offers numerous benefits, it’s important to be aware of potential risks such as dependency and mismanagement. Overreliance on debtor finance can lead businesses to neglect necessary improvements in efficiency or customer payment practices.

To mitigate these risks, maintain a balanced approach to financing and continue to pursue measures that enhance operational efficiency and invoice collection processes.

Additionally, businesses should carefully select a debtor finance provider that offers transparency, reasonable rates, and favorable terms. Regular review of the debtor finance arrangement can help identify any issues early and adjust strategies accordingly to ensure that the finance solution continues to meet the business’s changing needs.

Conclusion

In conclusion, debtor finance offers a flexible and effective solution for managing and improving business cash flow. Allowing businesses to borrow against their outstanding invoices, provides immediate working capital, thus fostering growth and operational stability.

Whether opting for invoice factoring or discounting, businesses can tailor debtor finance to their specific needs, ensuring they maintain momentum in today’s fast-paced market environment.

People Also Ask

Is there a maximum amount I can finance through debtor finance?

The amount available through debtor finance typically depends on the total value of your outstanding invoices and the terms set by the financier. It can increase as your sales and receivables grow.

How quickly can I access funds through debtor finance?

Typically, businesses can access funds within 24 to 48 hours after an invoice is verified and approved by the financier.

Can debtor finance affect customer relationships?

This depends on the type of facility used. Invoice factoring involves third-party communication with your customers, which can impact perceptions. However, invoice discounting keeps the process confidential, allowing businesses to manage their own customer relationships.

Is debtor finance expensive?

The cost of debtor finance depends on various factors, including the provider, the volume of invoices, and the risk profile of the business and its customers. While there are fees associated, the immediate boost to cash flow and growth potential can often outweigh these costs.

Muhammad Talha Naeem is a seasoned finance professional with a wealth of practical experience in various niches of the financial world. With a career spanning over a decade, Talha has consistently demonstrated his expertise in navigating the complexities of finance, making him a trusted and reliable figure in the industry.