Let’s investigate How Long Does It Take Brigit To Verify Debit Card? Waiting for your next direct deposit can seem like an eternity when you’re living paycheck to paycheck.

By day thirteen of the cycle, you’re scraping the last peanut butter from the jar, watering down your shampoo, and hoping you don’t have a minor problem like a flat tire or a malfunctioning washing machine.

But situations can arise occasionally; what options do you have then? You can use your credit cards more recklessly, close your eyes and let your bank account go into overdraft, or use Brigit, a novel app.

How Long Does It Take Brigit To Verify Debit Card?

After making sure that the one-cent micro-deposit was sent to your linked bank account, they can only verify your debit card. If they see the micro-deposit within three days, they can only confirm that the debit card belongs to you and is linked to the account.

What Is Brigit?

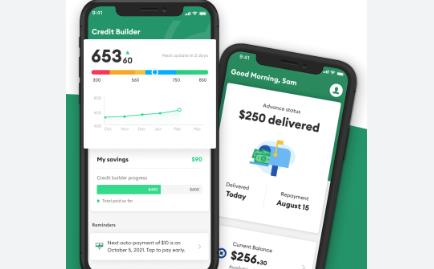

Software called Brigit might help you manage your money and keep you going until your next paycheck. The money it “spots” you has absolutely no interest applied to it.

Instead, think of Brigit as a safety net that can assist in preventing expensive overdrafts and holding a positive balance in your bank account.

Over 100 million Americans, many active service personnel or veterans, struggle to make ends meet. Nearly 30% of American individuals don’t have any emergency savings.

Banks and loan companies are exploiting the financial fragility of these hard-working people. Payday loans’ typical annual percentage rate (APR) can exceed 400 percent.

Overdraft charges can also go up quickly. Banks profited $34 billion off Americans waiting for their next paycheck in 2017 alone. That is absurd. And Brigit was developed to address this issue.

How Does Brigit Work?

Brigit, a platform for payday loans, gets its name from its goal of helping users “bridge” the gap between paychecks. Through its salary advances and additional features that reduce the severity of overdraft penalties, Brigit reduces the need for financially vulnerable people to take out unjust loans.

If they cannot provide their repayment on time, consumers can request a cash advance using the paycheck advance tool. Unlike traditional banks, credit unions, and loan sharks, Peer-to-peer (P2P) networks are used by lending apps like Brigit to level the playing field between lender and borrower. These serve as the apps’ building blocks. The app’s workflow is as follows:

- Brigit will link to the borrower’s bank account after the borrower registers for the app to confirm and determine a future payment schedule.

- The app evaluates the borrower’s average take-home income or their fixed wage component and confirms the borrower’s payment schedule.

- The software will track the amount of money credited to the borrower’s account daily once it knows how much the borrower makes hourly. This is done as part of the daily end-of-day reconciliation process.

- The borrower can input their timesheet each month they want to apply for loans or let Brigit track their earnings through their smartphone.

- Based on an inbuilt algorithm that determines the borrower’s capacity to repay their loans on time, the Brigit app enables the borrower to apply for an amount they believe is reasonable.

- A predefined sum is deducted from the borrower’s account when the paycheck is credited to cover the loan.

- The checking or pay account linked to the Brigit app needs to be current and have at least three direct deposits from the employer and a minimum of 60 days of activity.

- The borrower may be eligible for a payday advance of up to $250, depending on their pay. The Brigit app automatically alerts users when they look to be at risk of overdrawing their accounts and transmits a small loan amount.

How Brigit Makes Money?

The business strategy of Brigit does not only rely on frequent requests for advances or sizable loan borrowings. Conversely, it benefits Brigit when its member borrowers can better control their income and expenses and turn to her less frequently.

The business continually creates methods for managing cash flow for the advantage of customers who take out payday loans. A $10 monthly subscription fee is Brigit’s only source of income. On the app, there is a one-time fee and no ongoing advance fees applied to every dollar and transaction.

At any time in their lives, whether for paying bills, furthering their education, or simply celebrating a milestone, borrowers can access up to $250. Additionally, if the borrowers require access to funds for longer, they are free to request extensions.

Based on a consistent income and expenditure pattern, Brigit can also underwrite loans so that both daily or hourly pay workers and gig workers can benefit from them.

What If You Can’t Pay Brigit Back Right Away?

Brigit even provides free payment extensions within the app if you cannot make regular payments due to additional unplanned expenses. Thanks to this, users now have a little more choice in terms of repaying methods. When you’ve reimbursed Brigit, you can ask for more cash.

But Brigit will also put in extra effort on your behalf by monitoring your account regularly. You can set up your account so that Brigit will automatically send you a deposit if the software forecasts that you will run out of money before your next paycheck. Therefore, you can feel secure knowing that the organization always has a safety net ready.

How Much Does Brigit Cost?

How can Brigit make money, given that no interest is assessed on its accounts? Brigit charges a tiny monthly account fee of $9.99, less expensive than Netflix, instead of charging excessive interest!

You won’t ever see another fee or secret charge, either. Let’s contrast the alternatives to that $9.99 monthly cost. After two weeks, a $250 payday loan with an average APR of 391 percent would result in a $268.80 debt.

That is more than $18 that was essentially wasted. Additionally, the amount of interest due will increase unless it is paid in full within two weeks.

On the other hand, you would incur a cost of up to $40 per transaction if you allowed your account to go into overdraft. You’ll have to pay daily interest beyond 20% if your bank lends you money to cover the overdraft.

That $9.99 sounds much more attainable. Its strongest feature is the ability to turn the service on and off as needed. Thus, you are not required to register for the premium service immediately. Instead, you can download the app for free and upgrade to their commercial service if you need to access a salary advance.

Who Can Qualify For Brigit?

Because all you need to be eligible for Brigit is a US-based bank account and a steady source of income, it’s fantastic for military families. The firm doesn’t care if you have bad credit or fantastic credit. That should be taken into consideration.

Predatory loan firms have targeted service members with bad credit or no credit. This is despite the Military Lending Act of 2006, which set a 36 percent cap on APRs for loans to service members. That 36 percent, even at its utmost, is astonishingly high. No matter your credit rating, you won’t have to worry about being taken advantage of with Brigit.

Conclusion

After reading the above information you have learned How Long Does It Take Brigit To Verify Debit Card? For service members, veterans, and anyone else who struggles with money and lives paycheck to paycheck, Brigit might be a suitable fit.

Even though $250 may not seem like much, it could help you get by with your expenses and groceries until your next paycheck. Additionally, because there is a $250 cap, members are more inclined to refrain from using Brigit.

With that type of money, you won’t go out and buy Jet Skis on a whim. Brigit should be utilized to assist you and your family in strengthening your financial situation.

Frequently Asked Questions

How do I verify my debit card on Brigit?

To ensure that your debit card is connected to your checking account, Brigit will then put $.01 into your account. You can select Express Delivery when requesting advances once your debit card has been validated.

Does Brigit have a digital card?

A new brand of cash advance software called Brigit makes borrowing money simple and more inexpensive. Unlike many other apps, there is no Brigit debit card, and your direct deposit does not need to be moved.

Why can’t Brigit verify my debit card?

They can only authenticate your debit card after confirming that the one-cent micro-deposit was delivered to your connected checking account.

How long does it take to verify a debit card?

Your bank provides a verification code shortly after you verify in this manner. Tap Get another email or text if you don’t get one. Get in touch with your bank if you experience problems again.

A multifaceted professional, Muhammad Daim seamlessly blends his expertise as an accountant at a local agency with his prowess in digital marketing. With a keen eye for financial details and a modern approach to online strategies, Daim offers invaluable financial advice rooted in years of experience. His unique combination of skills positions him at the intersection of traditional finance and the evolving digital landscape, making him a sought-after expert in both domains. Whether it’s navigating the intricacies of financial statements or crafting impactful digital marketing campaigns, Daim’s holistic approach ensures that his clients receive comprehensive solutions tailored to their needs.